White House Summit: America's Bitcoin Superpower Drive

- Authors

- Published on

- Published on

In a groundbreaking move, the White House hosted its inaugural digital assets Summit, setting out to crown America as the unrivaled Bitcoin powerhouse. The Administration's swift embrace of technology underscores its commitment to upholding the US as the global Reserve currency. Amidst the crypto market's recent turbulence, a seasoned crypto co-founder proudly aligns with the Administration's vision, marking a pivotal moment in history. The event's significance reverberates through the halls of power, drawing resounding support from all corners.

While the crypto landscape grapples with bearish undertones due to speculative altcoin frenzy, Bitcoin's resilience shines through a recent 30% price dip, deemed par for the course. Despite a prevailing downtrend, a potential breakout looms with a descending wedge pattern hinting at an upward trajectory. Market dynamics, historical data, and key support levels offer a lens into the cyclical nature of crypto corrections, urging investors to weather the storm with a steady hand.

The aftermath of the Strategic Reserve announcement sees a familiar "buy the rumor, sell the news" narrative unfold, as market reactions remain tempered. From CPI data to global M2 Supply, various economic indicators play a role in shaping Bitcoin's trajectory. Patience emerges as a virtue, with seasoned investors advocating for strategic accumulation during market dips. Technical analysis points to a CME futures gap closure, potentially paving the way for a retest at higher price levels. The ebb and flow of market sentiment underscore the timeless allure of Bitcoin, enticing both seasoned traders and newcomers alike. Legislative efforts to establish a federal Bitcoin Strategic Reserve gain traction, buoyed by bipartisan support and a nod from the highest office in the land.

Amidst the market's tumultuous seas, the crypto industry finds solace in significant investments, exemplified by Abu Dhabi's monumental backing of Binance. This unprecedented influx of capital underscores a growing shift away from traditional financial systems towards the promise of crypto. As the crypto landscape evolves, with State-level adoption on the horizon, the stage is set for a potential market revolution. In the face of short-term volatility, a resounding bullish sentiment prevails, fueled by a steadfast belief in the transformative power of Bitcoin and the enduring spirit of innovation.

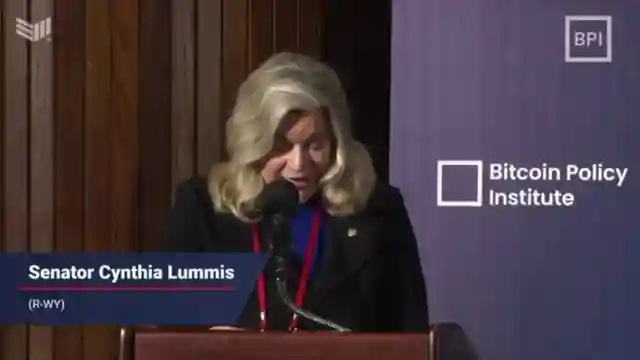

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch 🚨 BITCOIN!!!!! IS HISTORY ABOUT REPEAT ITSELF?!!!!! [the clock is ticking…] 🚨 on Youtube

Viewer Reactions for 🚨 BITCOIN!!!!! IS HISTORY ABOUT REPEAT ITSELF?!!!!! [the clock is ticking…] 🚨

Discussion on Bitcoin strategic reserve causing a sell-off

Speculation on Bitcoin bear market

Historic crashes and patterns emerging

Impact of QE and M2

Analysis on BTC vs altcoins

Comments on the current market situation

Appreciation for the content and analysis provided

Personal stories and experiences related to watching the channel

Mention of attending Bitcoin conference in Vegas

Questions and concerns about the market and investment strategies

Related Articles

Bitcoin's Growth Potential: Market Trends, Institutional Investments, and Price Predictions

Explore the potential of Bitcoin as it competes with global investments, with insights on market trends, institutional investments, and price predictions. Stay informed and calm amidst market fluctuations with Crypto Zombie.

Crypto Market Turmoil: Bitcoin Dips, Altcoin Losses, and Market Insights

Explore the recent crypto market turmoil on Crypto Zombie, analyzing Bitcoin's dips, altcoin losses, fear and greed index impact, and external market factors like Trump's tariffs. Delve into the largest hack in crypto history, conspiracy theories, and technical indicators signaling potential bear market trends.

Navigating the Crypto Chaos: Bitcoin Stability Amid Meme Coin Mania

Crypto Zombie explores the current crypto market, highlighting the rise of meme coins and the bearish sentiment despite strong Bitcoin fundamentals. FTX's creditor repayment, influx of new tokens, and the shift towards real-world assets are discussed, emphasizing the importance of long-term Bitcoin investment amidst market volatility.

Bitcoin Breakout: Potential for $100K-$300K, Corporate Interest Surges

Explore Bitcoin's recent breakout and potential for reaching $100,000-$300,000. Corporate interest grows, with countries like the US and Poland considering strategic Bitcoin reserves. The BlackRock Bitcoin ETF hits $40 billion. Experts predict Bitcoin could hit $1 million, highlighting its value as a hedge against inflation and unique investment opportunity.