Bitcoin Breakout: Potential for $100K-$300K, Corporate Interest Surges

- Authors

- Published on

- Published on

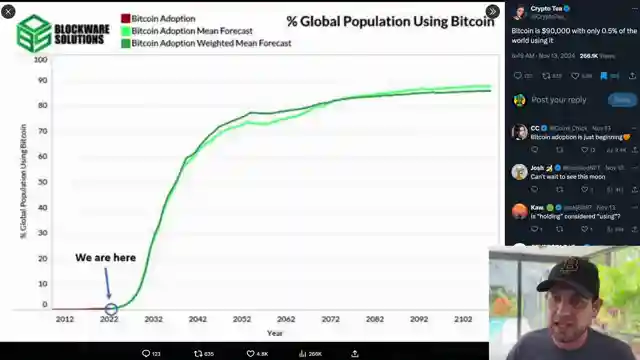

In this riveting episode of Crypto Zombie, the team delves into the exhilarating world of Bitcoin, exploring its recent breakout from a consolidation phase and the potential for a staggering price surge. As Bitcoin defies expectations and sets its sights on $100,000 or even $300,000, viewers are urged to reconsider their portfolio allocations and seize the opportunity for growth. The discussion heats up as countries like the US and Poland mull over the idea of strategic Bitcoin reserves, signaling a global shift towards embracing the leading cryptocurrency.

Corporate giants like MicroStrategy and MetaPlanet are making waves in the Bitcoin space, acquiring substantial amounts of the digital asset. Meanwhile, the BlackRock Bitcoin ETF skyrockets to $40 billion in assets, reflecting the escalating institutional interest in Bitcoin. As El Salvador and Bhutan lead the charge in accumulating Bitcoin, other nations, including the US state of Pennsylvania, are poised to follow suit, setting the stage for a widespread adoption of the digital currency.

The perception of Bitcoin as a risky asset undergoes a transformation, with many now recognizing it as a crucial hedge against inflation and a lucrative investment opportunity. With its unique characteristics setting it apart from traditional assets, Bitcoin offers uncorrelated returns and a compelling case for inclusion in investment portfolios. Experts predict a meteoric rise for Bitcoin, with prices potentially soaring to $1 million in the near future, underscoring the cryptocurrency's undeniable allure and disruptive potential in the financial landscape.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch BITCOIN!!!! DO YOU REALIZE WHAT’S ABOUT TO HAPPEN?!!! $1 TRILLION INFLOW!!! [MUST WATCH] 🚨 on Youtube

Viewer Reactions for BITCOIN!!!! DO YOU REALIZE WHAT’S ABOUT TO HAPPEN?!!! $1 TRILLION INFLOW!!! [MUST WATCH] 🚨

Polish presidential candidate is a BTC holder with $3 million in BTC

Reconsidering investment strategy due to stock market underperformance

Confidence in Bitcoin never going below $60k again

Interest in updates on ETH and alt season

Speculation on Bitcoin reaching $500k

Excitement for Bitcoin hitting $100k+

Appreciation for CryptoZombie's return and advice

Speculation on Bitcoin correction to $74k

Encouragement to buy more Bitcoin

Discussion on the uniqueness of the current market cycle and potential lack of significant pullbacks

Related Articles

Bitcoin's Growth Potential: Market Trends, Institutional Investments, and Price Predictions

Explore the potential of Bitcoin as it competes with global investments, with insights on market trends, institutional investments, and price predictions. Stay informed and calm amidst market fluctuations with Crypto Zombie.

Crypto Market Turmoil: Bitcoin Dips, Altcoin Losses, and Market Insights

Explore the recent crypto market turmoil on Crypto Zombie, analyzing Bitcoin's dips, altcoin losses, fear and greed index impact, and external market factors like Trump's tariffs. Delve into the largest hack in crypto history, conspiracy theories, and technical indicators signaling potential bear market trends.

Navigating the Crypto Chaos: Bitcoin Stability Amid Meme Coin Mania

Crypto Zombie explores the current crypto market, highlighting the rise of meme coins and the bearish sentiment despite strong Bitcoin fundamentals. FTX's creditor repayment, influx of new tokens, and the shift towards real-world assets are discussed, emphasizing the importance of long-term Bitcoin investment amidst market volatility.

Bitcoin Breakout: Potential for $100K-$300K, Corporate Interest Surges

Explore Bitcoin's recent breakout and potential for reaching $100,000-$300,000. Corporate interest grows, with countries like the US and Poland considering strategic Bitcoin reserves. The BlackRock Bitcoin ETF hits $40 billion. Experts predict Bitcoin could hit $1 million, highlighting its value as a hedge against inflation and unique investment opportunity.