US Gold Ban & Crypto: Past Lessons for Future Regulation

- Authors

- Published on

- Published on

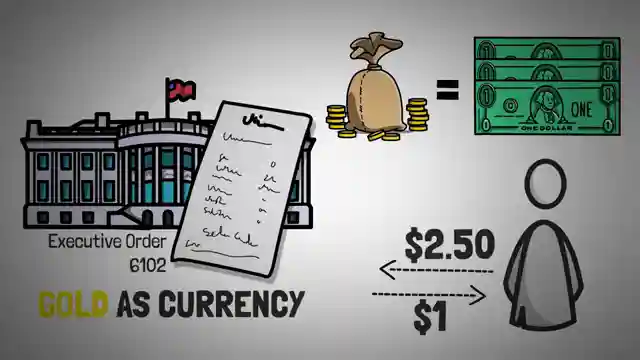

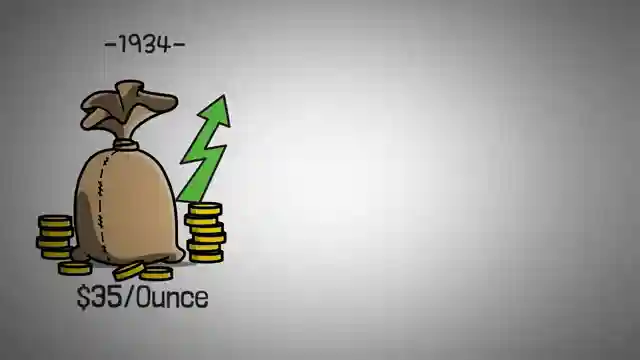

In a jaw-dropping revelation, Whiteboard Crypto delves into a pivotal moment in US history when the government shockingly banned private ownership of gold in 1933. This bold move, under Executive Order 6102, aimed to combat economic turmoil during the Great Depression by seizing citizens' gold and inflating its value by a staggering 75% in 1934. The government cunningly profited from this scheme by buying gold, printing more money, and stimulating the economy. But wait, there's more! This historical gold grab parallels a potential future showdown between governments and cryptocurrencies, as highlighted by the channel.

Drawing parallels between past and present, Whiteboard Crypto warns of a possible crypto crackdown akin to the gold confiscation saga. While governments could declare war on digital currencies, seizing them is no walk in the park. Unlike physical gold, which can be confiscated, cryptocurrencies pose a unique challenge due to their decentralized nature and reliance on private keys. The channel underscores the importance of vigilance in recognizing historical patterns and staying alert to potential threats in the crypto world.

As the video unfolds, viewers are taken on a riveting journey through the annals of economic history, where governments wielded power over currency values and monetary policies. The tale of the gold confiscation saga serves as a cautionary tale, urging audiences to remain vigilant against potential government interventions in the realm of cryptocurrencies. Whiteboard Crypto's insightful analysis not only educates but also sparks a sense of awareness regarding the evolving landscape of digital assets and the looming specter of government regulation.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch EO 6102: Why The US Banned Gold, and How it Applies to Crypto (Inflation) on Youtube

Viewer Reactions for EO 6102: Why The US Banned Gold, and How it Applies to Crypto (Inflation)

Comments about the return of the content creator

Concerns about the government's impact on the market

Mention of specific cryptocurrencies like AMS160T, Avalanche, Algo, Matic, RVX, Cyberopolis

Praise for Revux's community-driven approach and whitepaper

Discussion on the potential value of crypto despite US bans

Interest in the success of Cyberopolis and its presale phase

Mention of insider buzz and endorsements related to Cyberopolis

Views on the profitability of presales and ICOs compared to airdrops

Speculation on the future success of Cyberopolis

Observations on the involvement of big shots in Cyberopolis

Related Articles

Unveiling Pi Network: Mining Tokens on Smartphones - A Deep Dive

Discover Pi Network, a unique cryptocurrency project allowing users to mine Pi tokens on smartphones for Financial Independence. Learn about its innovative consensus mechanism, delayed main net launch, concerns, and uncertain future. #PiNetwork #cryptocurrency #mining

Master Crypto Tax Savings: Strategies, Loss Offsetting & Automation

Learn how to navigate crypto taxes post-losses with Whiteboard Crypto. Discover strategies to offset income, carry over losses, and automate tax prep with Coin Ledger. Master the art of tax-saving in the crypto world.

FTX Fiasco: Safeguard Your Assets with Self-Custody and Metamask

Learn from the FTX Fiasco discussed by Whiteboard Crypto. Safeguard your assets with self-custody using wallets like Metamask. Protect private keys, transfer funds securely, and take control of your cryptocurrency journey.

Unlocking Web3: Metamask & Consensus Revolutionizing Crypto

Explore Metamask, the leading self-custody wallet for Ethereum and web3, sponsored by Consensus. Learn about crypto wallets, NFTs, and Dows with Metamask Learn. Trust in Consensus, the blockchain tech powerhouse behind Metamask's innovative solutions.