Master Crypto Tax Savings: Strategies, Loss Offsetting & Automation

- Authors

- Published on

- Published on

In this exhilarating episode of Whiteboard Crypto, the team delves into the thrilling world of crypto taxes. They unveil the secrets to saving your hard-earned cash after facing losses in the tumultuous crypto market. From bear markets to rug pulls and the infamous FTX Fiasco, they guide you through the treacherous waters of capital gains and losses. Long-term holding emerges as the hero, slashing tax rates and rewarding the brave souls who weather the storm for over a year.

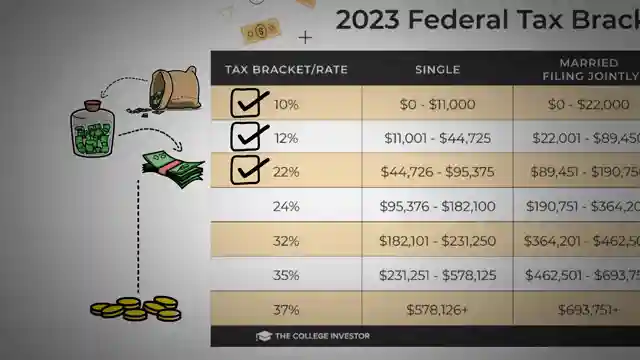

The adrenaline spikes as they dissect crypto income, unearthing the hidden gems of staking, yield farming, and airdrops. Brace yourself for the ride as they break down how this income falls under the same tax brackets as short-term capital gains, leading to higher tax rates for the daring crypto adventurers. An electrifying example showcases the calculation of taxes on combined income, shedding light on the intricate dance between earnings and tax liabilities.

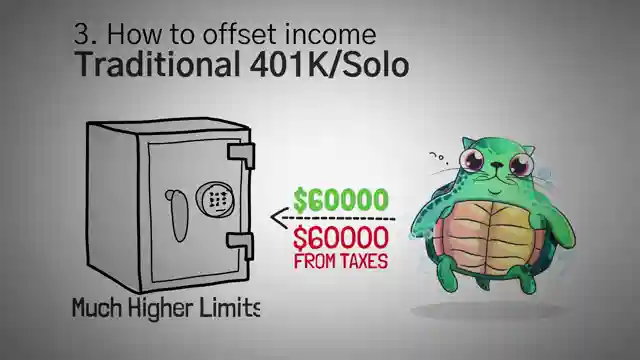

Hold on tight as the team zooms through strategies to offset income, including traditional IRAs, 401ks, HSAs, charity donations, and deducting business expenses related to crypto ventures. They reveal how losses can swoop in to rescue gains, offering a lifeline to those battered by market volatility. The pulse-pounding finale explores how losses from previous years can be carried over, turning the tables on tax obligations and potentially leading to a thrilling victory over the taxman. And in a heart-stopping twist, they introduce Coin Ledger as the ultimate tool for automating tax preparation, revolutionizing the way crypto warriors navigate the murky waters of tax season.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch How To Lower Your Taxes with Crypto - What You NEED To Know Before Filing on Youtube

Viewer Reactions for How To Lower Your Taxes with Crypto - What You NEED To Know Before Filing

Importance of spreading bets and thinking long term in trading

Caution on claiming losses due to theft

Request for a video on breaking down Internet Computer

Emphasis on understanding the bigger narrative behind BTC pumps

Interest in understanding why crypto is taxed

Inquiry about handling Voyager losses

Discussion on cryptocurrency investment strategies

Clarification on taxation when selling BTC into USDT

Interest in reviewing the $CRU project

Query about short or long term gains on selling BTC

Related Articles

Unveiling Pi Network: Mining Tokens on Smartphones - A Deep Dive

Discover Pi Network, a unique cryptocurrency project allowing users to mine Pi tokens on smartphones for Financial Independence. Learn about its innovative consensus mechanism, delayed main net launch, concerns, and uncertain future. #PiNetwork #cryptocurrency #mining

Master Crypto Tax Savings: Strategies, Loss Offsetting & Automation

Learn how to navigate crypto taxes post-losses with Whiteboard Crypto. Discover strategies to offset income, carry over losses, and automate tax prep with Coin Ledger. Master the art of tax-saving in the crypto world.

FTX Fiasco: Safeguard Your Assets with Self-Custody and Metamask

Learn from the FTX Fiasco discussed by Whiteboard Crypto. Safeguard your assets with self-custody using wallets like Metamask. Protect private keys, transfer funds securely, and take control of your cryptocurrency journey.

Unlocking Web3: Metamask & Consensus Revolutionizing Crypto

Explore Metamask, the leading self-custody wallet for Ethereum and web3, sponsored by Consensus. Learn about crypto wallets, NFTs, and Dows with Metamask Learn. Trust in Consensus, the blockchain tech powerhouse behind Metamask's innovative solutions.