Tyler S. Crypto Market Insights: Bounce, Recovery, and Trading Opportunities

- Authors

- Published on

- Published on

Today in the world of cryptocurrencies, the market is experiencing a slight bounce, keeping risk-on assets on edge as the money supply skyrockets. This surge is expected to trigger the fastest v-shaped recovery in history, leaving everyone wondering: will it be big or very big? Tyler S. delves into the dynamics at play, urging viewers to brace themselves for the impending pump by smashing that like button and subscribing to his channel. For those keen on Bitcoin, altcoins, or trading, FX or Bit Unix are the platforms to explore, with the added perk of no KYC requirements when using Tyler S.'s referral link.

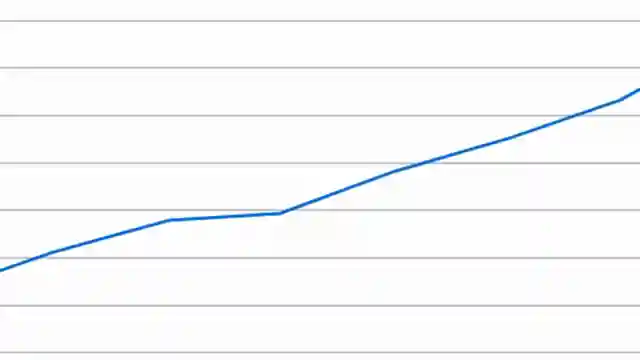

Analyzing a chart that seems almost too good to be true, Tyler S. contemplates potential market movements for Bitcoin. Despite recent dips, an inverted Bitcoin chart reveals a bullish trend, challenging viewers to rethink their biases. The surge in the M2 money supply since the beginning of 2025 hints at a delayed impact on assets like Bitcoin, setting the stage for a possible market shift. The current market downturn, attributed to the Trump Administration's tariff strategies to combat inflation, might pave the way for a manufactured pump in the future, should inflation decrease and the Fed intervene.

As the S&P and Bitcoin navigate intentional downtrends, Tyler S. emphasizes the importance of corrections for healthy market growth. Emotional trading and fear grip short-term investors facing losses, highlighting the significance of experience in navigating market fluctuations. A falling wedge pattern signals market apprehension, potentially indicating an approaching market bottom. Despite the prevailing market uncertainty, historical data underscores Bitcoin's long-term upward trajectory, urging investors to maintain a bullish outlook. Tyler S.'s insights on FX or Bit Unix offer valuable guidance for traders seeking opportunities in the ever-evolving crypto landscape, without the hassle of KYC requirements.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch HOLY F@&K.... BITCOIN BOTTOM SIGNAL? on Youtube

Viewer Reactions for HOLY F@&K.... BITCOIN BOTTOM SIGNAL?

Viewers are discussing the potential for Bitcoin to reach higher prices, mentioning figures like $130k and discussing market movements related to Trump's tweets.

There are comments about specific cryptocurrencies like Xonedium, with viewers expressing confidence in its potential for growth and discussing their investment strategies.

Some viewers are appreciating the content creator's videos and common sense approach.

There are mentions of humorous elements in the video, such as an inverted chart and a cat appearance.

Viewers are expressing loyalty to the content creator and their interest in watching more of their videos.

Some comments reference specific trading platforms and bonuses available.

There is a mix of humor, investment advice, and personal experiences shared in the comments.

Related Articles

Bitcoin Market Analysis: $500M Short Triggers Potential $90K Surge

Tyler S. explores a $500 million Bitcoin short, signaling a potential market shift towards a $90,000 surge. Amidst stock market recovery hints, bullish indicators on Bitcoin suggest a lucrative trade opportunity and a bullish trend.

Tyler S. Crypto Market Insights: Bounce, Recovery, and Trading Opportunities

Explore Tyler S.'s insights on the current crypto market bounce, potential v-shaped recovery, and impact of the M2 money supply surge. Learn about market trends, emotional trading, and the future outlook for Bitcoin and risk assets. Discover trading opportunities on FX or Bit Unix without KYC requirements.

Bitcoin and Inflation Analysis: Market Surge Potential

Inflation hits a four-year low as Bitcoin approaches key moving average. Global liquidity rises, US inflation drops, signaling potential for market surge. SEO-friendly summary of Tyler S. video analysis.

Navigating Cryptocurrency and Stock Market Turmoil: Insights and Predictions

Learn about the recent cryptocurrency and stock market turmoil on the Tyler S. channel. Explore the reasons behind the market crash, predictions for Bitcoin's future, and strategies to navigate the volatile landscape. Stay informed and prepared for potential market fluctuations.