Insights on Crypto Market Volatility and Altcoin Potential with Abra CEO

- Authors

- Published on

- Published on

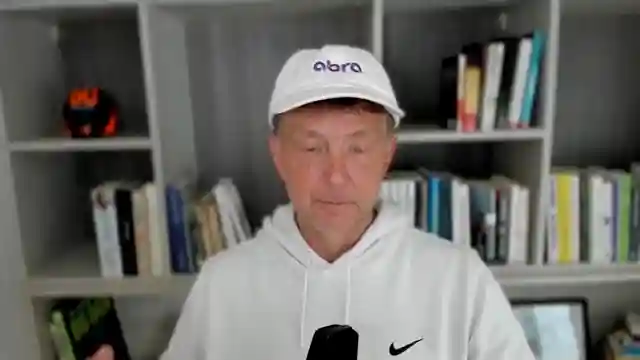

In this riveting interview on The Defiant, we meet Bill Barhydt, the mastermind behind Abra, a crypto advisory service catering to the elite. With a decade of crypto experience under his belt, Bill is a force to be reckoned with in the world of macro markets and crypto policies. Abra's primary goal is to empower clients to seize opportunities in the crypto sphere, offering wealth management services that include investing in crypto assets, earning yields, and leveraging crypto holdings. As a fiduciary, Abra goes the extra mile by providing tailored investment strategies, tax insights, and guidance on navigating the diverse landscape of crypto assets. Moreover, Abra's Prime brokerage arm is a game-changer, facilitating trading, derivatives, and lending activities for institutional players.

The recent market rollercoaster, triggered by US tariffs on major trade partners, has left Bitcoin languishing below the $100K mark. Bill sheds light on the intricate web of regulatory shifts and global economic dynamics that sway the prices of crypto assets. Drawing a compelling analogy, he likens crypto to a high-stakes bet on the dollar's depreciation, emphasizing the pivotal role of market liquidity, interest rates, and oil prices in shaping asset values. Altcoins such as Ethereum and Solana emerge as promising contenders, mirroring Bitcoin's evolutionary journey in previous cycles. Bill's crystal ball foresees a surge in crypto asset prices fueled by the race to the bottom in global currency values and the escalating trend of money printing.

As the discussion delves deeper, Bill unravels the potential repercussions of Doge's maneuvers and macroeconomic maneuvers on the economic landscape. He delves into the intricate dance between short-term and long-term interest rates, hinting at a possible decline in interest rates if structural challenges are effectively tackled. Bill's bold analysis of the current market cycle suggests that altcoins are on the brink of a monumental rally post the peak of Bitcoin dominance. Real-time inflation data presents a stark contrast to conventional reports, signaling a possible slowdown in economic activities. Armed with his data-driven approach, Bill challenges the status quo, advocating for a more nuanced understanding of market dynamics rooted in real-time, accurate information.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Bill Barhydt: The Next Altcoin Season, $350K Bitcoin & The Future of DeFi Banking on Youtube

Viewer Reactions for Bill Barhydt: The Next Altcoin Season, $350K Bitcoin & The Future of DeFi Banking

Comment about sending USDT from OKX wallet to Binance

Mention of updates to the Ethereum roadmap and its business model

Discussion on revenue accrual to L1 and scalability in L2 roadmap

Related Articles

Unleashing Innovation: Filecoin Revolutionizes Storage and AI on The Defiant

Explore the cutting-edge world of Filecoin on The Defiant, a decentralized storage network empowering AI innovation, journalism, and global information dissemination. Discover how Filecoin disrupts traditional storage with verifiability, cost-effectiveness, and censorship resistance.

Revolutionizing Fiat to Crypto: Transac's CEO Sammy St Unveils Global Vision

Transac, led by CEO Sammy St, revolutionizes Fiat to crypto on-ramps globally. Seamlessly blending traditional finance with decentralized principles, Transac navigates complex regulations and empowers users. With a focus on self-custody and streamlined KYC processes, Transac paves the way for a future where blockchain reshapes the financial landscape.

The Graph: Revolutionizing Web 3 Development with Decentralized Indexing

Explore The Graph's role as the Google of web 3, revolutionizing decentralized app development with its indexing network and GRT token incentives.

Coinbase VP Reveals DeFi Innovation: Collateralize Bitcoin for USDC Loans

Coinbase VP discusses new DeFi feature allowing users to collateralize Bitcoin for USDC loans via Moro protocol, emphasizing transparency and strategic vision for unlocking Bitcoin value.