Coinbase VP Reveals DeFi Innovation: Collateralize Bitcoin for USDC Loans

- Authors

- Published on

- Published on

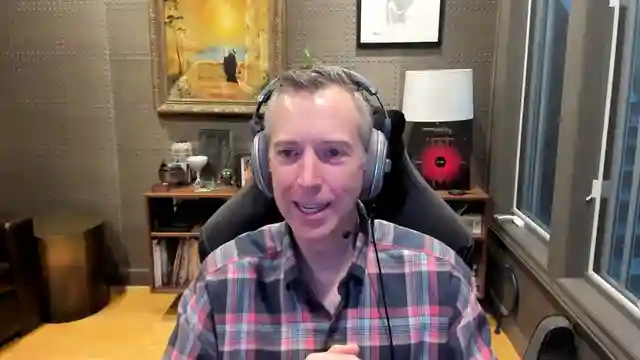

In this exhilarating episode of The Defiant, we are joined by the esteemed Will Robinson, the VP of engineering at the powerhouse known as Coinbase. Coinbase, a colossus in the crypto realm, has now ventured into the thrilling world of DeFi with a groundbreaking feature. This feature allows users to leverage their Bitcoin holdings for USDC loans through the innovative Moro protocol, offering a tantalizing opportunity to access liquidity without parting ways with their beloved Bitcoin. Will Robinson sheds light on the strategic decision to partner with Moro, citing its simplicity, security, and the rock-solid team behind it.

Transparency is the name of the game at Coinbase, as they meticulously communicate the risks involved in this new venture to their users. From smart contract risks to chain risks, users are educated on the potential pitfalls of over-collateralization and liquidation. The initial loan-to-value ratio of 86% adds an element of thrill to the mix, as users navigate the DeFi landscape with caution and excitement. As the product is gradually rolled out to users in the US, the response has been nothing short of exhilarating, with a remarkable 100% week-over-week growth that has left everyone at Coinbase buzzing with anticipation.

Will Robinson himself shares a personal anecdote of utilizing the product, highlighting the seamless experience of leveraging his Bitcoin holdings for a substantial loan within the Coinbase app. The decision to opt for CB BTC over WBTC as collateral speaks volumes about Coinbase's strategic vision to unlock the untapped potential of the billions of dollars worth of Bitcoin under their custody. With Coinbase at the helm, the future of DeFi integration looks brighter than ever, promising a thrilling journey for users seeking to make the most of their crypto assets.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch How Coinbase is Bridging Bitcoin to DeFi with New OnChain Lending | Will Robinson, VP of Engineering on Youtube

Viewer Reactions for How Coinbase is Bridging Bitcoin to DeFi with New OnChain Lending | Will Robinson, VP of Engineering

Praise for the content

Questions about transferring crypto from different wallets to exchanges

Seeking advice on transferring USDT from SafePal wallet to Binance

Seeking advice on transferring crypto from Bitget wallet to an exchange

Questions about transferring TRC20 USDT with a recovery phrase to Binance

Related Articles

Unleashing Innovation: Filecoin Revolutionizes Storage and AI on The Defiant

Explore the cutting-edge world of Filecoin on The Defiant, a decentralized storage network empowering AI innovation, journalism, and global information dissemination. Discover how Filecoin disrupts traditional storage with verifiability, cost-effectiveness, and censorship resistance.

Revolutionizing Fiat to Crypto: Transac's CEO Sammy St Unveils Global Vision

Transac, led by CEO Sammy St, revolutionizes Fiat to crypto on-ramps globally. Seamlessly blending traditional finance with decentralized principles, Transac navigates complex regulations and empowers users. With a focus on self-custody and streamlined KYC processes, Transac paves the way for a future where blockchain reshapes the financial landscape.

The Graph: Revolutionizing Web 3 Development with Decentralized Indexing

Explore The Graph's role as the Google of web 3, revolutionizing decentralized app development with its indexing network and GRT token incentives.

Coinbase VP Reveals DeFi Innovation: Collateralize Bitcoin for USDC Loans

Coinbase VP discusses new DeFi feature allowing users to collateralize Bitcoin for USDC loans via Moro protocol, emphasizing transparency and strategic vision for unlocking Bitcoin value.