Fear & Greed Index Shift, El Salvador Leads Bitcoin Accumulation Race

- Authors

- Published on

- Published on

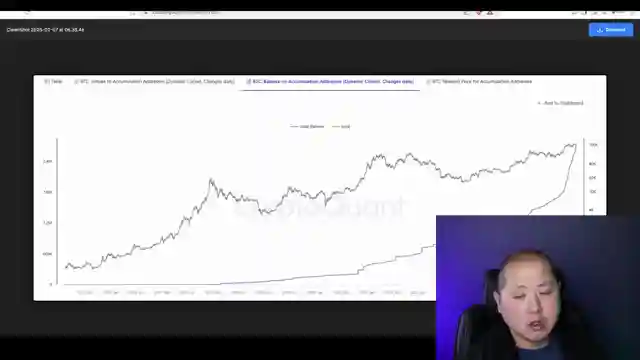

In this episode of CryptosRUs, George delves into the wild world of cryptocurrency with the fear and greed index making a dramatic shift to fear for the first time in ages. This change triggers a frenzy of liquidations and the lowest funding rate seen since 2014. Market makers are on a rampage, wiping out traders left and right as the market hurtles towards the coveted $100,000 mark. Meanwhile, a global race for Bitcoin accumulation is underway, with El Salvador leading the charge by ramping up their daily Bitcoin purchases and aiming to break free from traditional financial institutions like the IMF and the World Bank.

President Bukele's bold Bitcoin strategy could potentially lead to a massive stockpile worth billions, setting the stage for a new era of financial independence. Not to be outdone, Hong Kong and other countries like China and Russia are eyeing the creation of their own Bitcoin reserves, signaling a seismic shift in the global financial landscape. South Korea and Japan are also making waves in the crypto world, with discussions around the need for Bitcoin and Ethereum ETFs gaining traction. The allure of cryptocurrencies is undeniable, with top-tier countries around the globe vying for a piece of the action in this exhilarating race towards digital wealth and financial freedom.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Don’t Let Bitcoin Whales Fear You Out Of The Market on Youtube

Viewer Reactions for Don’t Let Bitcoin Whales Fear You Out Of The Market

Potential of SONY18S# and BTC

Holding onto ©Flokidonger and ADA

Concerns about market cap and circulation supply

Impact of whale games on rent payment

Gains made from the video recommendations

Speculation on SONY18S# reaching $15

Holding onto crypto out of spite towards manipulators

Predictions on market movement

Support for ©Flokidonger and SUI

Interest in $XAI17H, ADA, and SOL as top picks and potential gains

Related Articles

Unveiling Howard Lutnik's Influence: Trump's Economic Vision & Crypto Revolution

Explore the impact of Howard Lutnik's interview on Trump's economic policies and the crypto market. Discover how strategic collaborations and visionary appointments are shaping the future of finance.

Crypto Round Table, Ripple's Win, Institutional Bitcoin Interest & Trump's Stable Coin Support

CryptosRUs discusses SEC's crypto round table, Ripple's legal win, institutional interest in Bitcoin, and Trump's support for stable coins. Exciting insights into the evolving crypto landscape.

Trump Backs Bitcoin: Tether's Move and SEC's Rulings Signal Crypto Optimism

CryptosRUs analyzes Trump's support for Bitcoin and stable coins, Tether's US treasuries purchase, and the SEC's stance on Bitcoin and mining. Positive regulatory shifts signal a bright future for crypto despite market volatility.

CryptosRUs: Trump's Crypto Conference Message & Bitcoin Resilience

CryptosRUs explores President Trump's message at a crypto conference and the impact of potential Fed rate cuts on inflation. States creating Bitcoin reserves amid market uncertainty. Anticipated announcement at digital asset Summit with Trump's recorded appearance. Bitcoin remains strong in the red market.