Bitcoin Supply Shock: Florida's $1.5B Investment & Altcoin Surge

- Authors

- Published on

- Published on

In tonight's thrilling episode of Crypto R Us, the team delves into the heart-pounding world of Bitcoin and cryptocurrencies. Buckle up, because things are looking up! Bitcoin and several altcoins are on the rise, with a supply shock of epic proportions looming on the horizon. States like Florida are eyeing massive investments in Bitcoin, with Tesla already holding over a billion worth of the digital gold. The stage is set for a historic shift in the cryptocurrency landscape.

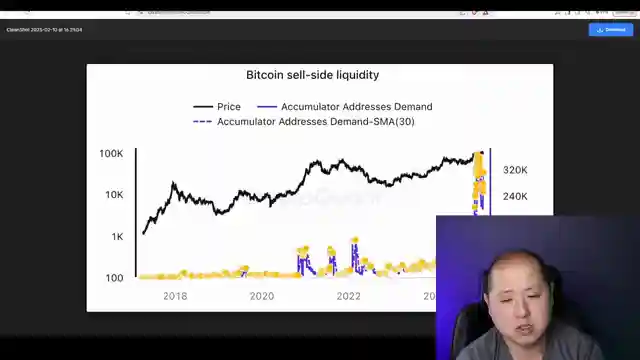

As the Bitcoin frenzy intensifies, major players like Meta are gearing up to acquire a whopping 21,000 Bitcoin by 2026. Banks, once hesitant, are now jumping on the Bitcoin bandwagon, signaling a seismic shift in the financial sector. The OTC market is running dry, with only 140,000 Bitcoin left, setting the scene for potential market disruptions as ETFs scramble for their monthly 50,000 Bitcoin fix. The team anticipates a wild ride ahead as the supply crunch tightens its grip.

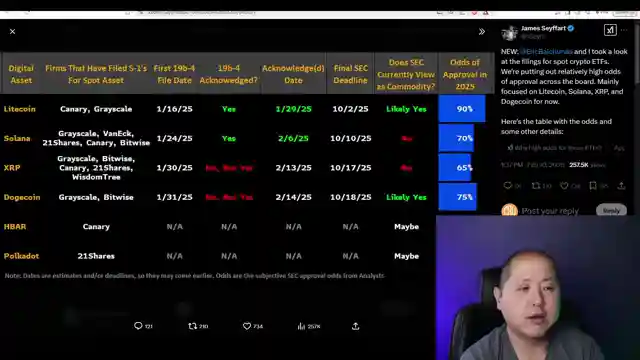

Turning our attention to the altcoin arena, Cardano emerges as a dark horse, poised to outshine Ethereum with potential ETF approval on the horizon. Meanwhile, Travago's integration with Travala opens new horizons for cryptocurrency enthusiasts looking to book hotels with over 100 digital currencies. The team wraps up the episode with a lively Q&A session, sharing insights on leverage trading and platform preferences. So grab your popcorn and settle in for a riveting ride through the ever-evolving world of cryptocurrencies on Crypto R Us!

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Prepare For The BIGGEST Bitcoin Supply Shock In History on Youtube

Viewer Reactions for Prepare For The BIGGEST Bitcoin Supply Shock In History

Viewers are discussing various cryptocurrencies such as $XAI50H, SHIBA, AVAX, and †Flokidonger

Some are expressing excitement and optimism about potential returns on investments

There are comments questioning the supply shock theory and the behavior of corporate/institutional buyers in the market

Mention of the ongoing debate between Jordan and Lebron as the GOAT in basketball

Some viewers are skeptical about the predictions and models used in the crypto market

Comments recommending the purchase of Trumnix and its potential for high returns

Reference to political figures like Trump affecting food prices and BTC prices

Some viewers are critical of the content creator's focus on certain cryptocurrencies and not others

Mention of potential BTC crashes and the launch of Trumnix in the future

A viewer mentioning being high and questioning news about El Salvador dropping BTC

Related Articles

Unveiling Howard Lutnik's Influence: Trump's Economic Vision & Crypto Revolution

Explore the impact of Howard Lutnik's interview on Trump's economic policies and the crypto market. Discover how strategic collaborations and visionary appointments are shaping the future of finance.

Crypto Round Table, Ripple's Win, Institutional Bitcoin Interest & Trump's Stable Coin Support

CryptosRUs discusses SEC's crypto round table, Ripple's legal win, institutional interest in Bitcoin, and Trump's support for stable coins. Exciting insights into the evolving crypto landscape.

Trump Backs Bitcoin: Tether's Move and SEC's Rulings Signal Crypto Optimism

CryptosRUs analyzes Trump's support for Bitcoin and stable coins, Tether's US treasuries purchase, and the SEC's stance on Bitcoin and mining. Positive regulatory shifts signal a bright future for crypto despite market volatility.

CryptosRUs: Trump's Crypto Conference Message & Bitcoin Resilience

CryptosRUs explores President Trump's message at a crypto conference and the impact of potential Fed rate cuts on inflation. States creating Bitcoin reserves amid market uncertainty. Anticipated announcement at digital asset Summit with Trump's recorded appearance. Bitcoin remains strong in the red market.