Ethereum ETF Approval Prospects: Regulatory Developments and CFTC Classification

- Authors

- Published on

- Published on

In this thrilling episode of Chico Crypto, we delve into the high-octane world of ETFs, where Bitcoin's success has set the stage for Ethereum's grand entrance. The Bitcoin ETF approval by the SEC sent shockwaves through the crypto market, propelling Bitcoin to unprecedented heights. Now, all eyes are on Ethereum as it gears up for its moment in the spotlight. With three Ethereum ETF applications looming on the horizon, including Vaneck, ARK 21Shares, and Hashdex Nasdaq, the stakes are higher than ever.

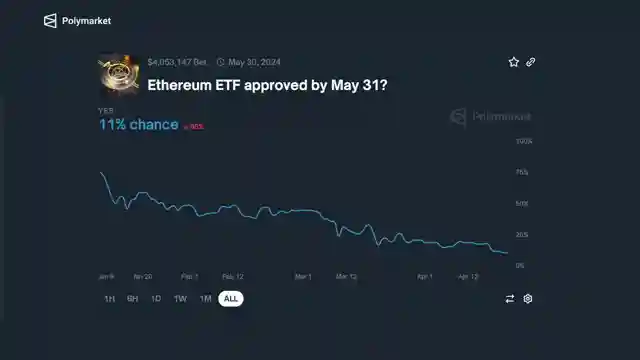

Despite the optimism surrounding Ethereum's ETF prospects, both sentiment and analysts paint a grim picture of its approval chances. The lack of engagement from the SEC raises red flags, hinting at a potential roadblock ahead. However, industry insiders like Grayscale's Craig Salm remain hopeful, emphasizing the similarities between Bitcoin and Ethereum ETFs. Yet, the looming specter of Ethereum being classified as a security by the SEC threatens to derail its ETF journey.

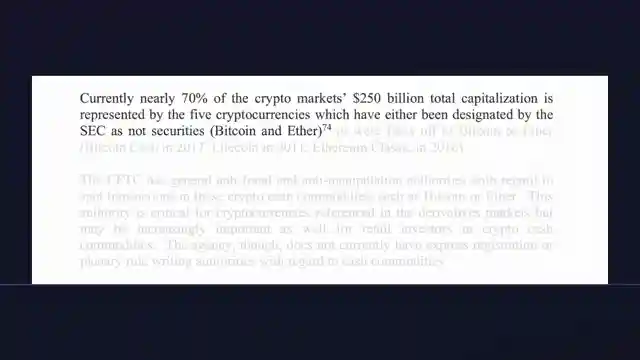

Amidst regulatory uncertainties, the CFTC's assertion of Ethereum as a commodity injects a glimmer of hope into the situation. With Prometheum's custody service for Ethereum making waves, Congress is pushing for clarity on Ethereum's classification, potentially forcing the SEC's hand. This mounting pressure could compel the SEC to designate Ethereum as a commodity, clearing the runway for an ETF approval. As the suspense builds, the crypto community eagerly anticipates the SEC's verdict on Ethereum's fate in the ETF arena.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch BREAKING!! Ethereum ETF Will Be SECRETLY Approved Next Month!! (100% PROOF) on Youtube

Viewer Reactions for BREAKING!! Ethereum ETF Will Be SECRETLY Approved Next Month!! (100% PROOF)

Discussion on the potential impact of Ethereum on Bitcoin

Mention of a glitch in a DEX platform

Speculation on the approval of an Ethereum ETF

Questions about the best strategies for crypto trading with different budget amounts

Comments on the changing nature of Ethereum from Proof of Work to Proof of Stake

Doubts about the approval of an Ethereum ETF

Mention of other cryptocurrencies like SOL, BTC, and LINK

Praise for the content creator's analysis and predictions

Reference to potential financial gains from cryptocurrency trading

Mention of specific investment strategies and opportunities

Related Articles

Bullish Bitcoin Forecast: Price Projection of 320k by 2025 Post-Halving Analysis

Chico Crypto analyzes Bitcoin's post-halving trajectory, noting a unique pre-halving surge. Historical data suggests a bullish future, predicting a potential price of 111k six months post-halving and 320k by 2025. Despite market uncertainty, Bitcoin's resilience shines through.

Unveiling RUNES: Bitcoin Halving Hype and Token Standards Explained

Explore the thrilling world of the Bitcoin halving and the rise of the innovative RUNES token standard in this Chico Crypto episode. Discover the hype, competition, and potential of Runes against the backdrop of evolving token standards.

Ethereum ETF Approval Prospects: Regulatory Developments and CFTC Classification

Explore the potential approval of Ethereum ETFs following Bitcoin's success. Despite low approval odds, regulatory developments may pave the way for Ethereum ETFs, with the CFTC viewing Ethereum as a commodity. Stay tuned for updates on this evolving story.

Unveiling Crypto Partnerships: PayPal, Energy Web, DMG, Blackrock

Explore groundbreaking partnerships in the crypto space with Chico Crypto. Discover real-world collaborations between giants like PayPal, Energy Web, DMG Blockchain, and Blackrock. Uncover the future of sustainable mining and aviation fuel certificates. Stay ahead with Chico Crypto!