Decoding Crypto Market Manipulation: Banks, Leaders, and Insider Tactics

- Authors

- Published on

- Published on

In this explosive exposé by Coin Bureau, the underbelly of the crypto market is laid bare, revealing a world of manipulation and deceit that would make even the most seasoned trader's head spin. Drawing parallels to the cutthroat practices of major banks in traditional markets, the channel sheds light on how collusion and insider trading run rampant, leaving unsuspecting investors at the mercy of these financial giants. With crypto being the wild west of finance, lacking proper regulation, manipulators roam free, wreaking havoc and sowing chaos with little consequence.

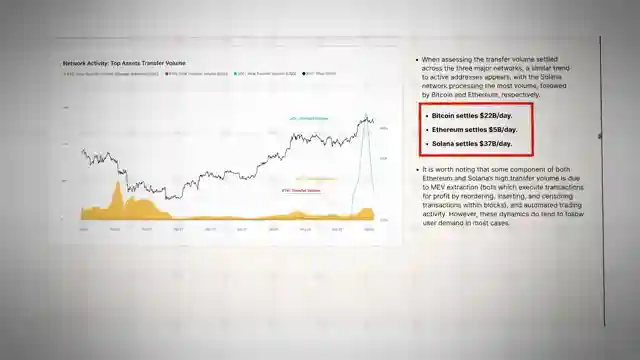

From pump and dump schemes to rigged token listings, the crypto market is a playground for those looking to make a quick buck at the expense of others. Decentralized exchanges, in particular, have become breeding grounds for manipulation, with practices like wash trading creating false illusions of market activity to lure in unsuspecting traders. The rise of meme coins like Trump and Libra has only intensified the situation, with on-chain manipulation tactics coming to the forefront and causing widespread market turmoil.

The involvement of world leaders in these dubious schemes has sent shockwaves through the crypto world, revealing the extent to which manipulation pervades even the most established cryptocurrencies. The concept of smart money preying on retail traders, orchestrating price movements to liquidate the unsuspecting, paints a grim picture of a market where the odds are stacked against the average investor. As Coin Bureau peels back the layers of deception in the crypto market, one thing becomes clear: behind every price movement lies a potential trap, waiting to ensnare the unwary and line the pockets of the manipulative few.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch They’re Manipulating the Crypto Market — And Here’s the Proof! on Youtube

Viewer Reactions for They’re Manipulating the Crypto Market — And Here’s the Proof!

Exchanges and manipulation in the crypto market

Impact of institutional investors on the market

Decentralization vs. government involvement in crypto

Advice on trading and investing in crypto

Concerns about market manipulation and the role of big wallets

Criticism of exchanges, particularly CEX

Comments on the manipulation of markets going up and down

Skepticism about the authenticity of market metrics

Frustration with manipulation leading to distrust in the crypto market

Personal experiences and reflections on trading and investing in crypto

Related Articles

Trump's Crypto Policies: Market Impact and Future Insights

Explore the impact of Trump's crypto policies in the US on the market. Learn about the strategic Bitcoin reserve, digital asset stockpile, and the potential for global crypto integration. Exciting insights into the future of cryptocurrency!

Unveiling the PayPal Mafia: Tech Titans, Politics, and Controversies

Discover the powerful influence of the PayPal Mafia on tech, politics, and the Trump Administration. Learn about key figures like Peter Thiel, Elon Musk, and David Sacks, their impact, and the controversies surrounding their involvement. Explore the intersection of tech, finance, and politics with the PayPal Mafia.

Upcoming Crypto IPOs: Circle, Kraken, Animoka Brands & More

Explore upcoming crypto IPOs with Coin Bureau: Circle, Kraken, Animoka Brands, Bullish Global, and Chain Analysis. Get insights into these game-changing companies set to shake up the financial market.

Unveiling the Potential: Retail Investors, Altcoins, and the Crypto Super Cycle

Coin Bureau explores the impact of retail investors on altcoins and the potential for a crypto super cycle. They debunk misconceptions, highlight exponential retail adoption growth, and predict increased investment in accessible cryptos on efficient blockchains like Solana. Institutions focus on utility-driven cryptos, while web 3 projects linked to gaming and social finance are poised for explosive growth. The next growth frontier lies in actual crypto adoption, with millions of active users driving industry disruption.