Bitcoin and Crypto Market Update: Positive Trends Amidst Inflation Concerns

- Authors

- Published on

- Published on

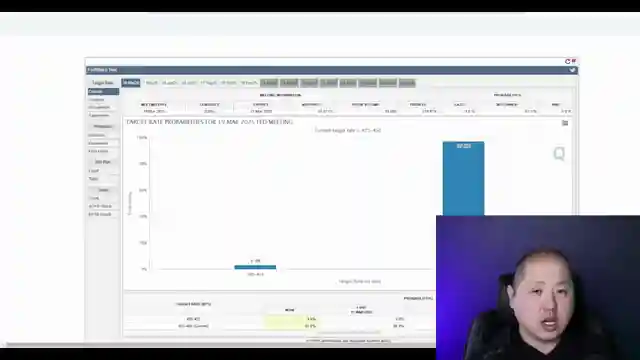

Today on CryptosRUs, the Bitcoin and crypto markets are experiencing a resurgence, with Bitcoin inching closer to the $84,000 mark. It seems that Asia and Europe have decided to take advantage of the dip, propelling the market upwards. The US market is also responding positively to lower inflation rates, providing a potential catalyst for further growth. As inflation numbers decrease, the possibility of a FED fund rate cut becomes more likely, easing financial pressures and boosting market confidence.

Amidst uncertainties surrounding tariffs and global economic tensions, there is a glimmer of hope in the form of a proposal for the US to acquire Bitcoin reserves to alleviate the national deficit. This bold move, supported by influential figures and policymakers, signifies a growing recognition of Bitcoin's potential to reshape traditional financial structures. While short-term market fluctuations may cause panic among retail investors, it is essential to remember that whales are strategically accumulating assets, anticipating long-term gains.

The anticipation of ETF approvals for various cryptocurrencies signals a potential influx of capital into the market, offering new opportunities for growth and investment. Furthermore, favorable regulatory changes are paving the way for American-based exchanges to operate more efficiently, expanding their services and reach. Despite the ebb and flow of market sentiment, the underlying belief in the long-term viability of Bitcoin remains steadfast, with strategic players like micro strategy consistently leveraging market dips to accumulate assets. As the market dynamics continue to evolve, the role of institutional investors and regulatory developments will play a crucial role in shaping the future trajectory of the crypto landscape.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch [URGENT] This Data Will Have A Huge Impact On Bitcoin and Crypto on Youtube

Viewer Reactions for [URGENT] This Data Will Have A Huge Impact On Bitcoin and Crypto

George is no longer doing live streams

Comments on BTC price movements and potential dumps

Mention of crypto TA videos being irrelevant

Institutional vs retail panic selling

Discussion on Trump's tariffs and their impact on the market

Concerns about portfolio losses and confusion on what to do

Speculation on potential gains with certain altcoins

Criticism of relying on news for trading decisions

Plans to buy at $70,000 and sell above $100,000

Positive comments on content and specific altcoin picks

Related Articles

Unveiling Howard Lutnik's Influence: Trump's Economic Vision & Crypto Revolution

Explore the impact of Howard Lutnik's interview on Trump's economic policies and the crypto market. Discover how strategic collaborations and visionary appointments are shaping the future of finance.

Crypto Round Table, Ripple's Win, Institutional Bitcoin Interest & Trump's Stable Coin Support

CryptosRUs discusses SEC's crypto round table, Ripple's legal win, institutional interest in Bitcoin, and Trump's support for stable coins. Exciting insights into the evolving crypto landscape.

Trump Backs Bitcoin: Tether's Move and SEC's Rulings Signal Crypto Optimism

CryptosRUs analyzes Trump's support for Bitcoin and stable coins, Tether's US treasuries purchase, and the SEC's stance on Bitcoin and mining. Positive regulatory shifts signal a bright future for crypto despite market volatility.

CryptosRUs: Trump's Crypto Conference Message & Bitcoin Resilience

CryptosRUs explores President Trump's message at a crypto conference and the impact of potential Fed rate cuts on inflation. States creating Bitcoin reserves amid market uncertainty. Anticipated announcement at digital asset Summit with Trump's recorded appearance. Bitcoin remains strong in the red market.