Crypto Market Fear: Germany & Mt. Gox Sell Bitcoin, ETF Support & Altcoin Hope

- Authors

- Published on

- Published on

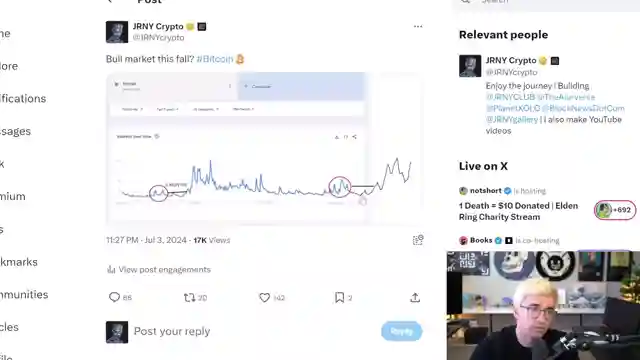

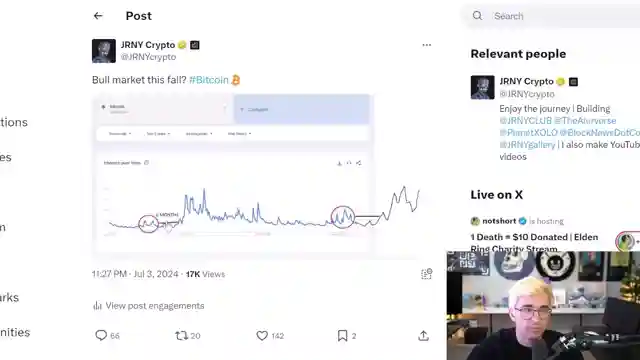

In this thrilling episode of JRNY Crypto, the market is in turmoil as Germany and Mt. Gox plan to offload billions in Bitcoin, sending shockwaves through the crypto world. The fear of a mass sell-off has caused a significant dip, with Bitcoin plummeting to $53,000 before a swift recovery. Meanwhile, Ethereum struggles below $3,000, awaiting the impact of upcoming spot ETFs. Retail interest in crypto is waning, but the influx of billions into Ethereum could provide a much-needed boost to prices.

As the stock market soars, crypto experiences a sharp decline, hinting at a potential decoupling between the two markets. Speculation runs wild about the end of the bull market, with contrasting views on its longevity. Amidst the chaos, Bitwise's CEO predicts a more stable Bitcoin market due to ETF support, offering a glimmer of hope in uncertain times. Additionally, Bitwise's plans for an Ethereum spot ETF promise further market support, potentially reshaping the crypto landscape.

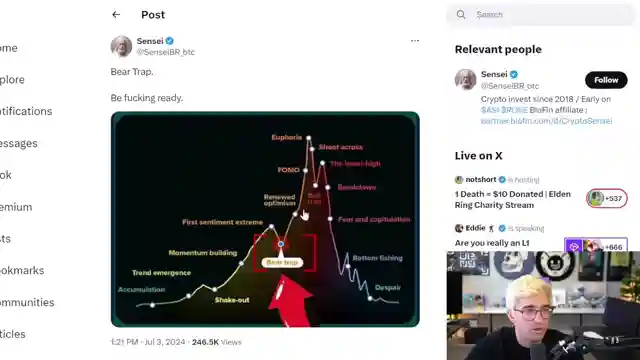

Despite the prevailing uncertainty, the market may be on the cusp of a resurgence akin to the "DeFi summer" of the last bull market. New innovations and altcoins are gaining traction, offering lucrative opportunities for investors. While fears of a bear trap linger, the gradual sell-off by Germany and Mt. Gox may not spell disaster for the market. The stock-to-flow model hints at a potential Bitcoin super cycle, painting a positive picture for the future of crypto. With exciting developments on the horizon and a wave of new blockchain projects, the crypto space is poised for a dynamic evolution, promising a thrilling ride for enthusiasts and investors alike.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch THIS IS BAD... Is the bull market over? on Youtube

Viewer Reactions for THIS IS BAD... Is the bull market over?

Young investors have a unique opportunity with compounding ahead of them

Concerns about the economy behind artificial numbers

Mention of scammers in the crypto space

Positive messages and prayers for someone going through a tough time

Swapping ETH for XAI80K and being up a little bit

Interest in Cardano picks

Speculation on Bitcoin's price falling below 40k

Comments on Tony's hair

Excitement and potential surrounding Versidium

Attention and hype around Cyberopolis

Related Articles

Navigating the Crypto Market Turbulence: Insights and Optimism for 2025

Explore the recent crypto market downturn and potential bullish events in 2025 with JRNY Crypto. Discover the impact of Trump's tariffs, SEC regulations, and upcoming trading challenges. Stay informed and navigate the crypto landscape with confidence.

Bullish Crypto Market: Google Ads Spark Retail Interest Pre-Bitcoin Halving

Google enabling Bitcoin and crypto ads sparks retail interest post-spot ETF approvals. Black Rock's ETF Bitcoin Holdings surpass $2 billion, setting the stage for a bullish crypto market leading up to the Bitcoin having event in less than 3 months. Stay tuned for more updates on altcoins and follow JRNY Crypto on Twitter for daily insights.

Bitcoin Surges Amid Grayscale Pressure: Google Ads and ETF Insights

JRNY Crypto discusses Bitcoin's recent surge despite Grayscale's selling pressure, Google's approval of crypto ads, Bitwise CEO's insights on Bitcoin ETFs, and Black Rock's webinar on Bitcoin ETF implications. Exciting times ahead in the crypto market!

Crypto Market Update: Bitcoin Surge, $1 Trillion Cap, Altcoin Season Ahead

Explore the current state of the crypto markets in this JRNY Crypto video. Bitcoin nears $1 trillion market cap with institutional interest surging. MicroStrategy's $10 billion Bitcoin holdings hint at a looming supply shock. Predictions range from $100,000 to $1 million for Bitcoin. Altcoin season awaits as retail interest grows post-halving. Discover promising projects like Arbitrum and Immutable X in the evolving crypto landscape.