Bitcoin Halving Impact: Market Trends, Price Movements & Altcoin Insights

- Authors

- Published on

- Published on

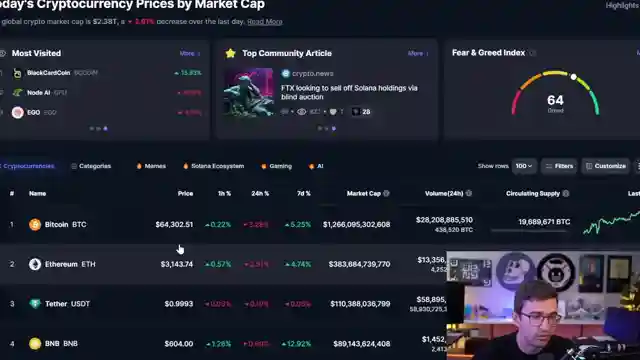

In this riveting episode of JRNY Crypto, Tony Jing delves into the thrilling world of Bitcoin halving and market dynamics. He paints a vivid picture of the reduced Bitcoin supply post-halving and the potential impact on prices, highlighting the critical role of demand in driving the market forward. With companies like MicroStrategy leading the charge in accumulating Bitcoin, the stage is set for a monumental price surge that could catapult Bitcoin to new heights.

Tony Jing doesn't shy away from the rollercoaster nature of the crypto market, emphasizing the necessity of market corrections and the historical patterns of bull markets. Drawing parallels to past trends, he underscores the significance of retail interest and the catalysts that could propel Bitcoin into a frenzy of activity. The recent Bitcoin halving and ETF approvals serve as the ignition for the next bull market, with trend levels poised to skyrocket and Bitcoin's value potentially reaching unprecedented levels.

As the discussion shifts to altcoin seasons, Tony Jing explores the key factors driving the success of various projects, such as high demand and innovative launches. He shares insights into potential altcoin gems and projects to watch, hinting at the exciting opportunities that lie ahead in the crypto sphere. Amidst speculations of market drops and contrasting opinions from industry figures, Tony Jing remains steadfast in his belief in the long-term viability of Bitcoin and crypto, advocating for strategic planning and resilience in the face of market uncertainties.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch WHAT'S NEXT FOR BITCOIN AND CRYPTO on Youtube

Viewer Reactions for WHAT'S NEXT FOR BITCOIN AND CRYPTO

Excitement for future developments

Discussion on BTC price targets and market predictions

Positive comments about Revux as a promising investment

Mention of successful investments and gratitude towards specific individuals

Speculation on the success and potential of Revux in the crypto market

Comments about missed content and requests for specific challenges

Recommendations for specific cryptocurrencies to invest in

Excitement and positive feedback on the video content

Mention of a past scam related to NFT collection

Discussion and interest in $EDSE memecoin, with comments on its profitability and potential

Related Articles

Navigating the Crypto Market Turbulence: Insights and Optimism for 2025

Explore the recent crypto market downturn and potential bullish events in 2025 with JRNY Crypto. Discover the impact of Trump's tariffs, SEC regulations, and upcoming trading challenges. Stay informed and navigate the crypto landscape with confidence.

Bullish Crypto Market: Google Ads Spark Retail Interest Pre-Bitcoin Halving

Google enabling Bitcoin and crypto ads sparks retail interest post-spot ETF approvals. Black Rock's ETF Bitcoin Holdings surpass $2 billion, setting the stage for a bullish crypto market leading up to the Bitcoin having event in less than 3 months. Stay tuned for more updates on altcoins and follow JRNY Crypto on Twitter for daily insights.

Bitcoin Surges Amid Grayscale Pressure: Google Ads and ETF Insights

JRNY Crypto discusses Bitcoin's recent surge despite Grayscale's selling pressure, Google's approval of crypto ads, Bitwise CEO's insights on Bitcoin ETFs, and Black Rock's webinar on Bitcoin ETF implications. Exciting times ahead in the crypto market!

Crypto Market Update: Bitcoin Surge, $1 Trillion Cap, Altcoin Season Ahead

Explore the current state of the crypto markets in this JRNY Crypto video. Bitcoin nears $1 trillion market cap with institutional interest surging. MicroStrategy's $10 billion Bitcoin holdings hint at a looming supply shock. Predictions range from $100,000 to $1 million for Bitcoin. Altcoin season awaits as retail interest grows post-halving. Discover promising projects like Arbitrum and Immutable X in the evolving crypto landscape.