Crypto Market Analysis: Powell Testimony, Binance Sell-Off, and Institutional Trends

- Authors

- Published on

- Published on

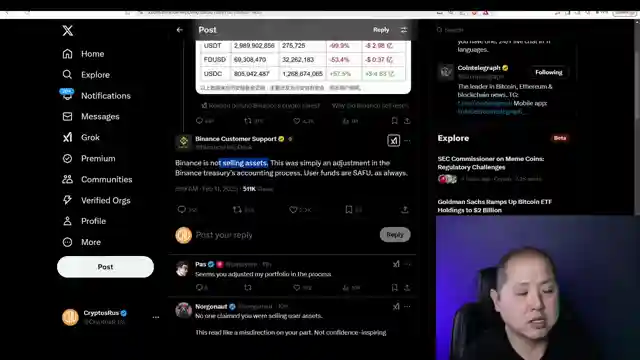

Today on CryptosRUs, George delved into the wild world of crypto markets following Fed Chair Powell's Senate testimony. The market reacted like a bull in a china shop, with Bitcoin and crypto prices taking a tumble. Despite Bitcoin's dip to $94k, altcoins surprisingly stood their ground amidst the chaos. Binance's mysterious asset sell-off in January raised eyebrows, leaving traders scratching their heads over the true motives behind the move. Powell's cautious approach to interest rates and inflation added fuel to the fire, stirring up uncertainty among investors.

In the midst of this financial rollercoaster, institutions like Goldman Sachs emerged as bullish players, boosting their ETF holdings by a whopping 105% in Q4. This move hinted at a deeper confidence in the crypto market's future potential. Furthermore, the upcoming FTX distribution of $16 billion in Stables injected a dose of optimism, potentially fueling a market resurgence. The prospect of ETF approvals for XRP, Solana, and even Doge sent ripples of excitement through the crypto community, hinting at a brighter tomorrow.

Amidst the turbulence, whispers of Bank of America's potential use of XRP for internal transactions added a layer of intrigue to the unfolding drama. Microsoft's reported discussions with Cardano and SBI Holdings' innovative move to offer dividends in XRP showcased a shifting landscape in the crypto sphere. As George navigated through viewer questions about state strategic reserves and the future of altcoins like Matic and ETH, the overarching message remained clear: amidst the storm, there lies a glimmer of hope and opportunity in the ever-evolving world of cryptocurrencies.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Bitcoin and Crypto Fall Based on Fed Chair's Lack of Urgency on Youtube

Viewer Reactions for Bitcoin and Crypto Fall Based on Fed Chair's Lack of Urgency

Discussion about various cryptocurrencies such as $XAI319K, $XAI50H, $ONDO, and Trumnix

Comments on market conditions, including predictions and strategies during bear markets

Criticisms of exchanges like Binance

Speculation on potential partnerships and future price movements

Excitement and investment in upcoming projects like Trumnix

Mention of web3 gaming and specific projects like Chumbi Valley

Rumors about involvement of Donald Trump in the Trumnix token

Personal investment decisions and beliefs in the potential of certain cryptocurrencies

Related Articles

Unveiling Howard Lutnik's Influence: Trump's Economic Vision & Crypto Revolution

Explore the impact of Howard Lutnik's interview on Trump's economic policies and the crypto market. Discover how strategic collaborations and visionary appointments are shaping the future of finance.

Crypto Round Table, Ripple's Win, Institutional Bitcoin Interest & Trump's Stable Coin Support

CryptosRUs discusses SEC's crypto round table, Ripple's legal win, institutional interest in Bitcoin, and Trump's support for stable coins. Exciting insights into the evolving crypto landscape.

Trump Backs Bitcoin: Tether's Move and SEC's Rulings Signal Crypto Optimism

CryptosRUs analyzes Trump's support for Bitcoin and stable coins, Tether's US treasuries purchase, and the SEC's stance on Bitcoin and mining. Positive regulatory shifts signal a bright future for crypto despite market volatility.

CryptosRUs: Trump's Crypto Conference Message & Bitcoin Resilience

CryptosRUs explores President Trump's message at a crypto conference and the impact of potential Fed rate cuts on inflation. States creating Bitcoin reserves amid market uncertainty. Anticipated announcement at digital asset Summit with Trump's recorded appearance. Bitcoin remains strong in the red market.