Bitcoin Price Drop Explained: Binance Reserves Sale and Tariffs Impact

- Authors

- Published on

- Published on

In this riveting episode of CryptosRUs, George delves into the tumultuous world of cryptocurrency with the finesse of a seasoned driver navigating treacherous terrain. The recent nosedive in Bitcoin's value is attributed to the imposition of tariffs on steel and aluminum imports, sending shockwaves through the market. Speculation runs rampant about a major exchange offloading significant reserves, causing ripples in altcoins like ADA and Litecoin. The EU's disdain for the tariff news adds another layer of complexity to the unfolding drama, setting the stage for a high-octane showdown.

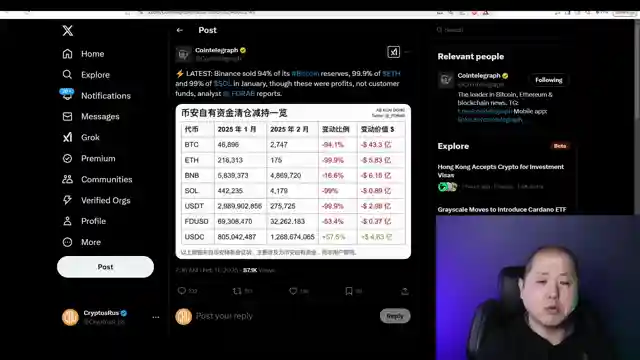

As the Federal Reserve's Powell prepares to address the tariff-induced inflation concerns, the team braces for potential market upheaval. Reports surface of Binance parting ways with a substantial portion of its Bitcoin, Ethereum, and USDT reserves, sparking a frenzy of theories ranging from liquidity boosts to doomsday preparations. The air crackles with anticipation as the crypto community ponders the motives behind this mysterious move, with whispers of acquisition talks with financial behemoth Black Rock adding fuel to the fire.

Amidst the chaos, the team stands firm in their belief in Bitcoin's long-term promise, urging viewers to look past short-term distractions and focus on the coin's scarcity and future value. Despite market volatility, stalwart entities like MicroStrategy and Metaplanet continue to pour millions into Bitcoin, underscoring its status as the ultimate financial frontier. The ongoing SEC lawsuit against Binance over alleged securities listings hangs in the balance, awaiting regulatory clarity that could reshape the exchange's trajectory. As CZ acknowledges flaws in Binance's token listing process, the spotlight shifts to maverick Dave Portnoy's rollercoaster ride with meme coins, a cautionary tale in the unpredictable world of crypto.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Is Binance the Reason Bitcoin and Crypto Keeps Dumping? on Youtube

Viewer Reactions for Is Binance the Reason Bitcoin and Crypto Keeps Dumping?

Concerns about market manipulation by Binance and other exchanges

Speculation on the future price of $XAI319K

Criticism of Binance's actions

Advice to withdraw assets from exchanges

Discussion on the involvement of Wall Street in crypto

Comments on Trump and politics

Suggestions for transferring USDT from wallets to Binance

Mention of potential web3 game project Chumbi Valley

Reference to supply shock and holding cash

Comparison of ETH, SOL, and BTC as "shitcoins"

Related Articles

Unveiling Howard Lutnik's Influence: Trump's Economic Vision & Crypto Revolution

Explore the impact of Howard Lutnik's interview on Trump's economic policies and the crypto market. Discover how strategic collaborations and visionary appointments are shaping the future of finance.

Crypto Round Table, Ripple's Win, Institutional Bitcoin Interest & Trump's Stable Coin Support

CryptosRUs discusses SEC's crypto round table, Ripple's legal win, institutional interest in Bitcoin, and Trump's support for stable coins. Exciting insights into the evolving crypto landscape.

Trump Backs Bitcoin: Tether's Move and SEC's Rulings Signal Crypto Optimism

CryptosRUs analyzes Trump's support for Bitcoin and stable coins, Tether's US treasuries purchase, and the SEC's stance on Bitcoin and mining. Positive regulatory shifts signal a bright future for crypto despite market volatility.

CryptosRUs: Trump's Crypto Conference Message & Bitcoin Resilience

CryptosRUs explores President Trump's message at a crypto conference and the impact of potential Fed rate cuts on inflation. States creating Bitcoin reserves amid market uncertainty. Anticipated announcement at digital asset Summit with Trump's recorded appearance. Bitcoin remains strong in the red market.