Bitwise Investments: Crypto Management, AI Insights & Tariff Impact

- Authors

- Published on

- Published on

Today on Real Vision, we dive into the world of Bitwise Investments, the crypto asset manager that's making waves in the financial industry. With a team spanning the US and Europe and over $10 million in client assets, Bitwise is not just a player in the game - they're the game changers. They're not afraid to give back, donating a generous 10% of their Bitcoin and Ethereum ETF profits to open source developers. And let's not forget, they were the pioneers in transparency by publishing their Bitcoin ETF wallet address. Bitwise Investments is the real deal, folks.

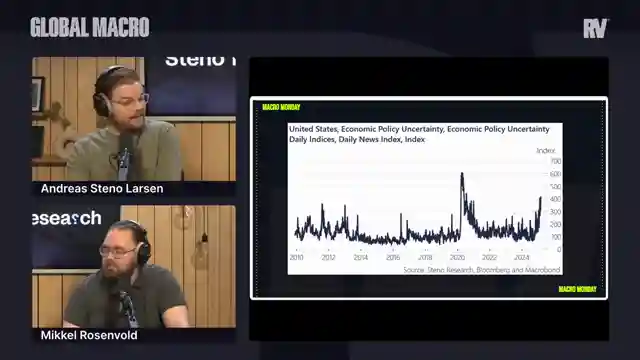

Shifting gears, Real Vision takes us to an AI event in Singapore where the brightest minds converge to unravel the mysteries of artificial intelligence. Meanwhile, Michel and Andreas from Real Vision dissect the macroeconomic landscape, tackling the uncertainties in trade and policy that are rocking the markets. The Trump administration's strategic moves to lower the dollar and bond yields are scrutinized, with predictions of a potential market rally in the horizon. But let's not get too comfortable, as looming challenges like reciprocal tariffs keep the analysts on their toes.

Andreas delves into the intricate world of tariffs, exploring their impact on inflation and the complex web of pricing dynamics. With a keen eye on import price indexes, he paints a vivid picture of the potential effects of tariffs on imported goods. Real Vision doesn't just scratch the surface - they dive deep into the nitty-gritty details, providing viewers with a comprehensive understanding of the economic landscape. So buckle up, because Real Vision is taking you on a thrilling ride through the highs and lows of the financial world.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Have We Reached the Bottom in Equities? Macro Monday ft. Andreas Steno & Mikkel Rosenvold on Youtube

Viewer Reactions for Have We Reached the Bottom in Equities? Macro Monday ft. Andreas Steno & Mikkel Rosenvold

Andreas' knowledge is praised

Banana Zone is mentioned as sick

Macro Mondays are appreciated

Discussion on chaos and lack of plan

Broadcasting from Andreas's basement is noted

Concern about the podcast

Mention of a potential lost decade

Germany's infrastructure and defensive spending are discussed

Timing to buy in a bear market is highlighted

Mention of potential impact of the most powerful country mentioning a plan for a BTC reserve

Related Articles

Exploring Bitwise: Crypto Asset Management and Market Insights

Real Vision explores Bitwise, a leading crypto asset manager with innovative products and a transparent approach. They discuss AI trends, market volatility, and geopolitical events, providing valuable insights for investors.

Bitwise Investments: Crypto Management, AI Insights & Tariff Impact

Real Vision explores Bitwise Investments, a leading crypto asset manager with $10 million in client assets. They discuss AI advancements and macroeconomic trends, including the impact of tariffs on inflation. A deep dive into the complexities of pricing dynamics and import price indexes.

Bitwise: Leading Crypto Asset Manager & Trump's US Crypto Reserve Announcement

Real Vision explores Bitwise, a leading crypto asset manager with $10B+ in assets and a diverse product range. They discuss Trump's US Crypto Reserve announcement, including Ripple and Cardano, and the implications for the crypto market and geopolitical landscape.

Blockchain Events, Trump Tariffs, and Market Trends: Real Vision Insights

Real Vision explores blockchain events, Trump tariffs, and market trends like Ethereum sentiment and manufacturing growth. Insights on Fed liquidity and investment opportunities in banking and tech are shared.