Bitcoin Demand Surges: Price Rally Towards $500,000 Expected

- Authors

- Published on

- Published on

In this riveting discussion by the Crypto Zombie crew, the spotlight shines on the escalating demand for Bitcoin, outstripping the available supply and setting the stage for a monumental price surge. They delve deep into the realm of Bitcoin reserves, hinting at an imminent rally hurtling towards the stratospheric $500,000 mark. Drawing parallels between the market caps of Bitcoin and gold, they illuminate a seismic generational shift favoring Bitcoin as the coveted store of value, leaving gold in the rearview mirror.

The conversation takes an intriguing turn as the team dissects the recent massive withdrawal of over $5 billion worth of Bitcoin from exchanges, painting a vivid picture of investor sentiment veering towards a steadfast hodling strategy. The narrative expands to encompass the insightful remarks of SES's CEO, shedding light on the burgeoning significance of Bitcoin in combating stealthy inflationary taxes lurking within traditional financial systems. This introspective journey leads to a profound exploration of the intrinsic value of money and the detrimental impact of incessant money printing on asset devaluation, unveiling startling revelations that challenge conventional financial wisdom.

Venturing further into the annals of Bitcoin's evolution, the team reflects on its humble origins as a rebellious cryptocurrency designed to liberate individuals from the shackles of centralized control. Through the lens of renowned trader Bob Lucas, a cautiously optimistic outlook emerges, underpinned by a harmonious convergence of market cycles, fundamental factors, institutional involvement, regulatory developments, and prevailing narratives within the Bitcoin ecosystem. Lucas' prudent optimism hints at potential surprises awaiting in this cycle, fueled by unprecedented institutional engagement and legislative advancements that could potentially catapult Bitcoin into uncharted territory, defying expectations and rewriting the rules of the game.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch 🚨 BITCOIN ALERT!!! LIQUIDITY CRUNCH SOON!!!!! WARNING: IT’S ABOUT TO GET INTENSE!!!! on Youtube

Viewer Reactions for 🚨 BITCOIN ALERT!!! LIQUIDITY CRUNCH SOON!!!!! WARNING: IT’S ABOUT TO GET INTENSE!!!!

Market Overview

Fibonacci Levels/Tops

Huge Pool of Capital

BTC To Hits Gold MC

Exchange Balances

Realized Price Bands

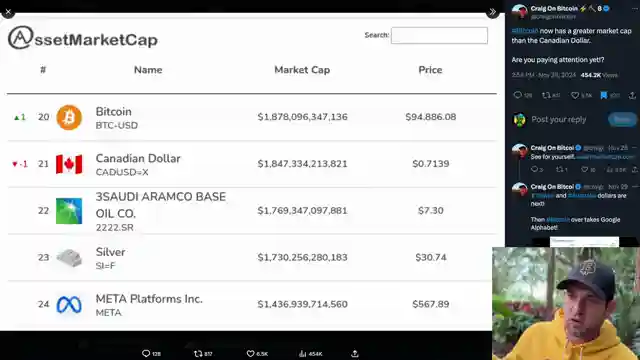

Bitcoin Surpasses CAD

The Hidden Tax (Why BTC)

Banks Will Be Obsolete?

Russia Legalizes Crypto

Related Articles

Bitcoin's Growth Potential: Market Trends, Institutional Investments, and Price Predictions

Explore the potential of Bitcoin as it competes with global investments, with insights on market trends, institutional investments, and price predictions. Stay informed and calm amidst market fluctuations with Crypto Zombie.

Crypto Market Turmoil: Bitcoin Dips, Altcoin Losses, and Market Insights

Explore the recent crypto market turmoil on Crypto Zombie, analyzing Bitcoin's dips, altcoin losses, fear and greed index impact, and external market factors like Trump's tariffs. Delve into the largest hack in crypto history, conspiracy theories, and technical indicators signaling potential bear market trends.

Navigating the Crypto Chaos: Bitcoin Stability Amid Meme Coin Mania

Crypto Zombie explores the current crypto market, highlighting the rise of meme coins and the bearish sentiment despite strong Bitcoin fundamentals. FTX's creditor repayment, influx of new tokens, and the shift towards real-world assets are discussed, emphasizing the importance of long-term Bitcoin investment amidst market volatility.

Bitcoin Breakout: Potential for $100K-$300K, Corporate Interest Surges

Explore Bitcoin's recent breakout and potential for reaching $100,000-$300,000. Corporate interest grows, with countries like the US and Poland considering strategic Bitcoin reserves. The BlackRock Bitcoin ETF hits $40 billion. Experts predict Bitcoin could hit $1 million, highlighting its value as a hedge against inflation and unique investment opportunity.