Wall Street Banks Embrace Blockchain: Goldman Sachs Leads Industry Shift

- Authors

- Published on

- Published on

In the thrilling world of finance, Wall Street mega banks are finally unleashing their blockchain prowess as regulatory shackles loosen. The burning question on everyone's mind: will these financial juggernauts flood the market with crypto offerings or stick to their cozy private blockchains? It's a high-octane showdown between tradition and innovation, with Goldman Sachs revving up to spin out its blockchain division in a bold move that could reshape the entire financial landscape. The stage is set for a clash of titans as big banks navigate the uncharted waters of crypto adoption.

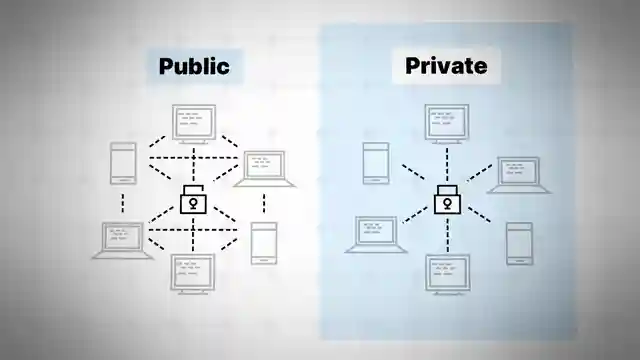

Goldman Sachs, a name synonymous with Wall Street prestige, is making waves by venturing deeper into the blockchain realm. Their plan to spin out the blockchain division hints at a strategic shift towards industry-owned infrastructure, signaling a potential game-changer in the banking sector. As the gears of innovation turn, traditional financial institutions are embracing blockchain technology to gain a competitive edge, streamline operations, and enhance transparency. However, the divide between private, centralized blockchains favored by banks and the public, decentralized chains of the crypto world remains a key point of contention.

Amidst the regulatory rollercoaster, US institutions have been grappling with the SEC's watchful eye, limiting their foray into the wild world of crypto. But winds of change are blowing, hinting at a brighter future for crypto integration in traditional banking. Regulatory clarity on custody rules could pave the way for banks to offer a wider array of crypto services, potentially democratizing access to digital assets. The race is on for banks to adapt to the evolving financial landscape, where asset tokenization looms large as the next frontier in the quest for efficiency and innovation. As the engines roar and the dust settles, one thing is clear: the future of finance is being reshaped before our very eyes, with banks at the helm of a new era of digital transformation.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Wall Street's Secret Plan For Crypto: What The Banks Are Doing!! on Youtube

Viewer Reactions for Wall Street's Secret Plan For Crypto: What The Banks Are Doing!!

Discussion about the reluctance to give up power in the financial sector

Mention of various cryptocurrencies like Hedera, Algo, XLM, and XRP

Comments on the potential of DeFi and concerns about centralization

Praising the presenter and the educational content of the video

References to specific cryptocurrencies like DogelonMars, AMP, and XLM

Talks about the potential of Quant in facilitating interoperability between bank chains

Mention of DTCC working with Chainlink

Speculation about the future of the crypto market in 2025

Comments on the potential role of large banks in storing Bitcoin

Debate about the origins of blockchain technology and Satoshi Nakamoto's contributions

Advocacy for investing in XRP and its future potential

Optimism about the transition to blockchain and crypto for a decentralized financial system

Related Articles

Trump's Crypto Policies: Market Impact and Future Insights

Explore the impact of Trump's crypto policies in the US on the market. Learn about the strategic Bitcoin reserve, digital asset stockpile, and the potential for global crypto integration. Exciting insights into the future of cryptocurrency!

Unveiling the PayPal Mafia: Tech Titans, Politics, and Controversies

Discover the powerful influence of the PayPal Mafia on tech, politics, and the Trump Administration. Learn about key figures like Peter Thiel, Elon Musk, and David Sacks, their impact, and the controversies surrounding their involvement. Explore the intersection of tech, finance, and politics with the PayPal Mafia.

Upcoming Crypto IPOs: Circle, Kraken, Animoka Brands & More

Explore upcoming crypto IPOs with Coin Bureau: Circle, Kraken, Animoka Brands, Bullish Global, and Chain Analysis. Get insights into these game-changing companies set to shake up the financial market.

Unveiling the Potential: Retail Investors, Altcoins, and the Crypto Super Cycle

Coin Bureau explores the impact of retail investors on altcoins and the potential for a crypto super cycle. They debunk misconceptions, highlight exponential retail adoption growth, and predict increased investment in accessible cryptos on efficient blockchains like Solana. Institutions focus on utility-driven cryptos, while web 3 projects linked to gaming and social finance are poised for explosive growth. The next growth frontier lies in actual crypto adoption, with millions of active users driving industry disruption.