Unveiling Fort Knox: Gold Reserves Audit Impact on Global Stability

- Authors

- Published on

- Published on

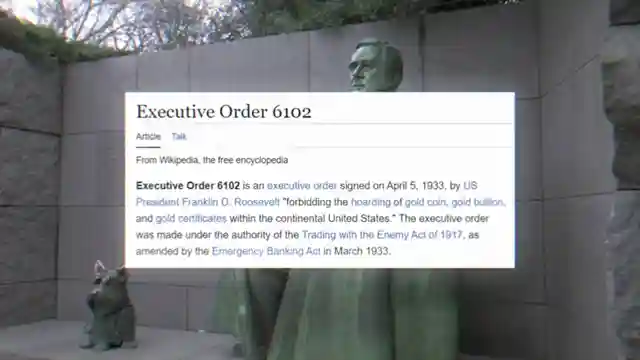

In this riveting episode of DataDash, we delve into the enigmatic world of Fort Knox's gold reserves, a topic that has Elon Musk and politicians buzzing with skepticism. The lack of audits at this legendary vault has raised eyebrows, leaving us all wondering: is the gold really there? Back in 1933, the US government seized citizens' gold to prop up the economy during the Great Depression. This move led to the creation of Fort Knox, a fortress built to protect the nation's massive gold stockpile. But fast forward to 1971, when the gold standard was abandoned, casting a shadow of doubt over Fort Knox's future.

The secrecy shrouding Fort Knox has only fueled suspicions about the existence of the gold within its walls. Enter Doge, the potential auditors who could finally unveil the truth behind America's gold reserves. Should they discover that the gold is less than claimed, the consequences could be catastrophic, triggering a financial crisis of epic proportions. Gold reserves are not just shiny bars; they are a cornerstone of financial stability and global influence, with countries like China and Russia strategically amassing gold for geopolitical leverage.

But in this modern age of digital assets like Bitcoin, the concept of reserves is evolving. Blockchain technology offers transparency and decentralization, challenging the traditional gold reserves. The future may see a blend of physical commodities and digital assets in nations' reserve strategies. As the world shifts towards transparency and adaptability, the revelation of Fort Knox's true gold reserves could shake the very foundations of the global financial system. The burning question remains: should the public have the right to know the reality behind Fort Knox's mysterious gold reserves, or is ignorance truly bliss in this high-stakes financial game?

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Fort Knox Stolen Gold is MISSING? The BIGGEST Cover-Up in History… on Youtube

Viewer Reactions for Fort Knox Stolen Gold is MISSING? The BIGGEST Cover-Up in History…

Importance of knowing the truth about the gold at Fort Knox

Skepticism about the existence of gold at Fort Knox

Debate on the gold standard and its implications

Advocacy for digital gold like Bitcoin

Criticism of the gold standard and preference for silver

Arguments against cryptocurrencies as true currencies

Proposal for a circulating silver coin standard

Criticism of Bitcoin and the US dollar as tokens

Doubt about the value and integrity of Bitcoin

Speculations about Elon Musk and the gold at Fort Knox

Related Articles

Unveiling the Economic Crisis: Private Equity's Threat to Businesses and Retirement Savings

DataDash uncovers a hidden crisis in the economy caused by private Equity firms' risky debt practices, threatening businesses and retirement savings. Learn how to protect your financial future in the face of this looming threat.

Crypto Market Update: CME Solana Futures, XRP Lawsuit, Fed Meeting Impact

DataDash covers CME's Solana Futures, XRP lawsuit drop, Fed meeting impact, Q1 end, and Trump's tariff proposal. Bitcoin and Ethereum price analysis, Sui's traction, and key levels are discussed for potential market movements.

Crypto Market Update: Stable Coin Regulations, Binance Delisting, and XRP Surge

The crypto market faces upheaval with stable coin regulations, Binance delisting Tether, and XRP's regulatory clarity. Bitcoin eyes $95,000, XRP targets $3.80 resistance, signaling market shifts ahead.

Satoshi Nakamoto Identity: Is Jack Dorsey the Real Creator of Bitcoin?

Unraveling the mystery of Bitcoin's creator: Could Jack Dorsey be Satoshi Nakamoto? Explore the compelling evidence and contradictions in this intriguing investigation.