Unlocking Corporate Success: Embracing Bitcoin as the Ultimate Tech Investment

- Authors

- Published on

- Published on

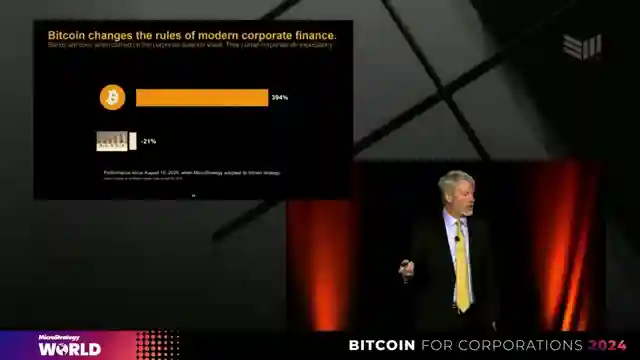

In this riveting Bitcoin Magazine discussion, the team delves into the peril of traditional treasury assets being toxic for companies, shortening their lifespan. By injecting poison into their veins, these assets are essentially signing their death warrant within 20 years. However, the game changes when companies like MicroStrategy embrace Bitcoin, outperforming tech giants like SAP, IBM, and Salesforce. With a large portion of their assets in Bitcoin, these companies are thriving, showcasing the power of adopting healthy assets over toxic ones.

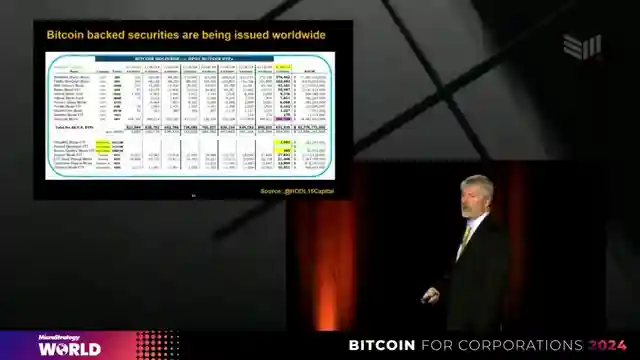

Bitcoin emerges as the ultimate tech investment, defying convention and offering unparalleled potential for growth. Financial advisors are scrambling to find alternative investments that can stand the test of time, with family offices turning to Bitcoin as the best alternative asset. Its uncorrelated nature to currencies and counterparties, coupled with its global, non-sovereign, and liquid characteristics, make Bitcoin a standout choice in a sea of traditional investments. As the ecosystem of Bitcoin-backed securities and derivatives continues to expand, the network's growth seems inevitable.

Bitcoin isn't just a digital currency; it's a revolution, a game-changer, and the best idea in the financial world. From offering a safe haven for billions to serving as a path to peace and prosperity, Bitcoin's potential knows no bounds. As we witness the evolution of Bitcoin from idealists to institutions, it's clear that the era of institutional adoption is upon us. With the network poised to grow from one trillion to 100 trillion, the future of finance lies in the hands of those who dare to embrace the power of Bitcoin.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Michael Saylor: Bitcoin As The Ultimate Corporate Treasury Asset | Bitcoin for Corporations 2024 on Youtube

Viewer Reactions for Michael Saylor: Bitcoin As The Ultimate Corporate Treasury Asset | Bitcoin for Corporations 2024

Positive feedback on the video content and speaker

Comments on making profits in the market

Mention of Bitcoin and buying BTC

Questions about transferring USDT from OKX to Binance

Comments on the decentralization of transactions

Reference to specific cryptocurrencies like SOLANA, ADA, and XAI195K

Mention of Binance infinity ETH bug

Speculation on the impact of Michael on global politics

Comments on the market being unstable and the need to focus on making profits now

Mention of following trading strategies like taking profits when bullish and buying when bearish

Related Articles

US Administration's Bitcoin Strategy: Insights from Economist Dr. Safedino Moose

US administration's bold move into Bitcoin with a strategic reserve and Tether integration discussed by economist Dr. Safedino Moose. Insights on implications for global economy and cryptocurrency market.

Unveiling Walker America's Bitcoin Journey: From TikTok to Bitcoin Conferences

Explore Walker America's journey into Bitcoin, from viral Tik Tok videos to MCing Bitcoin conferences. Learn how he and Carl are shaping the Bitcoin narrative, defying gatekeepers, and becoming cultural icons in the Bitcoin community.

US Designates Bitcoin as Strategic Asset: Insights from Casa CEO Nick Newman

The United States designates Bitcoin as a strategic asset, establishing a strategic Bitcoin reserve and digital asset stockpile. Casa CEO Nick Newman discusses self-custody and the importance of robust security measures in this new landscape. US Marshals audit Bitcoin holdings for security insights.

GameStop's Bitcoin Treasury Strategy: A Financial Revolution Brewing

Explore the potential synergy between GameStop and Bitcoin as Bitcoin Magazine discusses GameStop's possible entry into the world of Bitcoin treasury assets. Could GameStop follow in the footsteps of companies like MicroStrategy and Metap Planet, reshaping its financial future and rewriting history?