Top 5 Tokenized Real-World Assets (RWA) Cryptocurrencies Explained

- Authors

- Published on

- Published on

In this riveting exploration by the Coin Bureau team, we are thrust into the thrilling world of tokenized real-world assets (RWAs). It's like a high-stakes poker game, with asset managers like Black Rock going all-in on launching tokenized RWAs left, right, and center. The buzz around these digital assets is akin to the roar of a V8 engine, with stable coins serving as a prime example of how RWAs are revolutionizing the game. Chainlink emerges as the unsung hero, a decentralized Oracle Network ensuring the integrity of asset data in RWA projects, with its LINK token revving up the engine of accurate data provision.

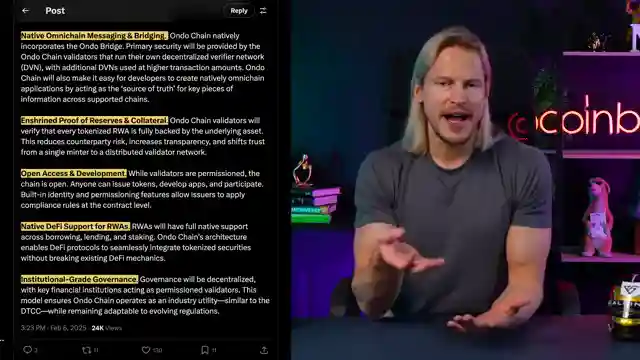

Enter Onomy Protocol, the heavyweight contender in the RWA arena, known for its transparent and compliant approach to tokenizing traditional assets. With products like USDY stablecoin and groundbreaking announcements like Onomy Global Markets and Onomy Chain, they're like a seasoned driver dominating the racetrack. Mantra steps up to the plate as the dark horse, a layer 1 blockchain powerhouse prioritizing regulatory compliance and making waves in regions like the Middle East and Asia. The OM token fuels the engine of governance and utility in the Mantra ecosystem, promising a thrilling ride for investors.

Sky, formerly MakerDAO, emerges as the wildcard in this RWA showdown, using real-world assets like US Treasury bonds and mortgage loans to back its stablecoin USDS. The SKY token plays a pivotal role in governance and maintaining stability, ensuring a smooth ride in the turbulent waters of the crypto market. And then, like a seasoned veteran, Ethereum takes the stage, flexing its muscles as the dominant force in the RWA sector. With its ERC standards and layer 2 ecosystem, Ethereum is like a well-oiled machine, facilitating the tokenization of real-world assets and setting the pace for the future of RWAs.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Top 5 RWA Cryptos: Institutions Are REALLY Bullish On These!! on Youtube

Viewer Reactions for Top 5 RWA Cryptos: Institutions Are REALLY Bullish On These!!

Tokenisation as the first real use case for crypto

Realio being a potential game-changer with low market cap

Mention of different cryptocurrencies such as $OM, $Link, $ONDO, $XRP, $XLM, $XDC, $ALGO, $HBAR, $PLUME, $ETH, $RBNT, $RIO, $PI, and $GFI

Discussion on RWA applications and narratives

Disappointment in Coin Bureau dismissing Algorand

Request for more in-depth videos on certain cryptocurrencies like ICP and DigiFT

Mention of potential partnerships such as Ondo with Ripple

Investment advice on diversifying income streams with assets like gold, silver, and digital assets

Speculation on the price of Ondo reaching $8 and its potential impact

Question about Maker and Sky tokens confusion

Curiosity about the absence of certain cryptocurrencies like ALGO

Mention of AVAX and Clearpool as potential outperformers

Reference to Link being compared to Google in the blockchain space

Related Articles

Trump's Crypto Policies: Market Impact and Future Insights

Explore the impact of Trump's crypto policies in the US on the market. Learn about the strategic Bitcoin reserve, digital asset stockpile, and the potential for global crypto integration. Exciting insights into the future of cryptocurrency!

Unveiling the PayPal Mafia: Tech Titans, Politics, and Controversies

Discover the powerful influence of the PayPal Mafia on tech, politics, and the Trump Administration. Learn about key figures like Peter Thiel, Elon Musk, and David Sacks, their impact, and the controversies surrounding their involvement. Explore the intersection of tech, finance, and politics with the PayPal Mafia.

Upcoming Crypto IPOs: Circle, Kraken, Animoka Brands & More

Explore upcoming crypto IPOs with Coin Bureau: Circle, Kraken, Animoka Brands, Bullish Global, and Chain Analysis. Get insights into these game-changing companies set to shake up the financial market.

Unveiling the Potential: Retail Investors, Altcoins, and the Crypto Super Cycle

Coin Bureau explores the impact of retail investors on altcoins and the potential for a crypto super cycle. They debunk misconceptions, highlight exponential retail adoption growth, and predict increased investment in accessible cryptos on efficient blockchains like Solana. Institutions focus on utility-driven cryptos, while web 3 projects linked to gaming and social finance are poised for explosive growth. The next growth frontier lies in actual crypto adoption, with millions of active users driving industry disruption.