President Trump Signs Executive Order Establishing US Bitcoin Reserve

- Authors

- Published on

- Published on

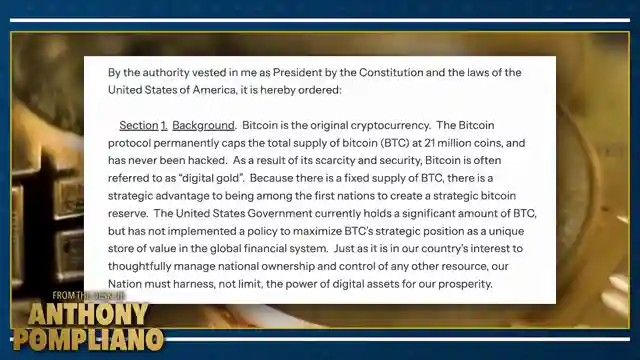

Today on Anthony Pompliano, we witnessed President Trump boldly signing an executive order to establish a strategic Bitcoin Reserve, propelling the US into the forefront of the global Bitcoin accumulation race. With the US set to become one of the largest holders of Bitcoin worldwide, this move marks a seismic shift in the financial landscape. The executive order strategically leverages existing coins as seed capital, emphasizing Bitcoin's digital gold status, security, and scarcity. Not stopping there, the US government cleverly paves the way for future Bitcoin purchases without burdening taxpayers, a masterstroke that garners praise from all sides.

In a surprising twist, the US administration distinguishes between Bitcoin and altcoins, showing support for the latter while focusing on Bitcoin accumulation. Treasury Secretary Scott Bessent hints at innovative ways to fund future Bitcoin purchases, hinting at a bold and proactive approach that sets the US apart in the crypto world. This bold move not only cements the US's position as a major player in the Bitcoin game but also sends a clear message to other nations: the race to accumulate Bitcoin is on, and the US is leading the charge. Despite market expectations, Bitcoin's price reaction post-announcement highlights the nuances of market dynamics and investor sentiment, showcasing how the market often fails to grasp the bigger picture.

The US government's embrace of Bitcoin represents a significant turning point in the history of finance, with far-reaching implications for global economic systems and individual financial freedom. This move not only validates Bitcoin's status as a revolutionary financial asset but also underscores the power of decentralized currencies in challenging traditional financial paradigms. As the US takes this monumental step towards embracing Bitcoin, it opens up a new chapter in the story of financial innovation and economic empowerment. The journey ahead promises to be filled with twists and turns, but one thing is clear: the era of Bitcoin has well and truly arrived, and the world will never be the same again.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch We Finally Have A Strategic Bitcoin Reserve! on Youtube

Viewer Reactions for We Finally Have A Strategic Bitcoin Reserve!

Positive reactions to the news about the US government holding Bitcoin

Comments on the growth and acceptance of Bitcoin over the years

Speculation on which government might be next to make a similar move

Mention of Bitcoin prices dropping despite the news

Appreciation for Anthony Pompliano's insights

Comparison between Anthony Pompliano and Rustin at Simply Bitcoin for information and entertainment

Comments on the impact of the US government's Bitcoin holdings on the market

Criticism of the US government's actions regarding Bitcoin

Speculation on the US government potentially confiscating more Bitcoin

Political opinions related to Democrats and Trump's statements on Bitcoin

Related Articles

Riot's Bitcoin Mining to AI HPC Venture: Attracting Blue-Chip Investors

Riot leverages Bitcoin assets to venture into AI HPC, attracting blue-chip investors. Texas facilities offer grid power, targeting hyperscalers for long-term leases. Regulatory changes bring certainty, enabling strategic partnerships and maximizing shareholder value amidst industry shifts.

Unlocking Bitcoin Potential: Gold Certificates & Stable Coin Regulation Insights

Explore the potential of converting gold certificates to buy Bitcoin and the discussion around stable coin regulation in Anthony Pompliano's insightful video. Learn about the need for statutory frameworks, Bitcoin strategic reserves, and digital asset regulation.

Financial Expert Insights: Bitcoin, Gold, ETFs, and Global Trends

Financial expert managing $120B assets discusses Bitcoin & gold dynamics, ETF liquidity impact, global trends, and US fiscal policy implications. Exciting insights into digital assets and investment strategies.

Trump's Influence on Bitcoin and Growth of Bitwise ETFs

Anthony Pompliano discusses Trump's impact on Bitcoin, the significance of community in the crypto space, the Middle East's interest in Bitcoin, and the growth of Bitcoin ETFs by Bitwise.