Navigating the Potential US Recession: Insights from Lark Davis

- Authors

- Published on

- Published on

Is a recession for the USA overdue? Lark Davis delves into this burning question with his signature analytical flair. The National Bureau of Economic Research, or Nur, serves as the gatekeeper for officially declaring recessions, typically occurring every 5-6 years. Despite Nur's exclusion of 2022 from recession counts, many argue that the impact of that year's economic downturn has been merely delayed, causing a ripple effect. By examining macroeconomic indicators such as the housing market and unemployment rates, Davis paints a vivid picture of the current economic landscape, rife with conflicting signals and potential pitfalls.

The housing market emerges as a crucial barometer, showing a decline in existing home sales and consumer housing sentiment. Unemployment numbers, while slightly up, reveal a 4.1% rate and a decrease in the number of employed individuals, sparking concerns about the labor market's stability. The inversion of the yield curve in February 2025, a favorite recession indicator, further muddies the waters, potentially heralding an economic downturn within the next 6-24 months. Consumer spending takes a hit in January 2025, coupled with a drop in consumer sentiment, signaling potential economic turbulence on the horizon.

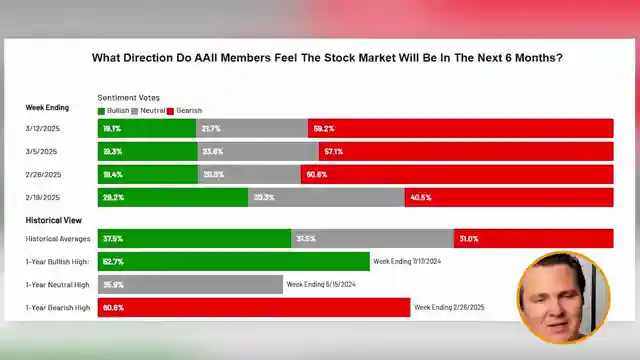

Amidst increasing bearishness in the American Association of Individual Investors sentiment survey and dire predictions from financial giants like JP Morgan and Fidelity, the specter of a recession looms large. The Atlanta Fed's GDP forecast paints a grim picture of negative growth trends, hinting at stormy weather ahead. Despite some glimmers of positivity, such as the ISM Manufacturing PMI and dropping oil prices, the overarching message remains clear: caution and preparation are paramount in navigating the choppy waters of the impending economic storm.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Is the Recession Overdue? [The Numbers Don’t Lie] on Youtube

Viewer Reactions for Is the Recession Overdue? [The Numbers Don’t Lie]

Discussion on whether or not the economy is in a recession

Comments on government spending propping up the economy

Mention of crypto YouTubers talking about a recession

Concerns about the economy since Biden was elected

Speculation on Jerome Powell's actions regarding interest rates

Mention of bitcoin dominance dropping

Comments on the length of time since a recession

Conspiracy theories about Illuminati involvement

Recommendations to invest in specific cryptocurrencies like $XAI30S and SUI

Speculation on the future of cryptocurrency markets

Related Articles

Adapting to the New Era: Navigating Crypto's Evolution

Lark Davis explores the evolving crypto landscape, signaling the end of easy gains. Investors must adapt to Wall Street influence, seek new opportunities like humanoid robotics, and embrace strategic profit-taking in a maturing market.

2025 Market Forecast: Tax Cuts, Tariffs, and Crypto Insights

Lark Davis explores the 2025 market outlook, discussing tax cuts, tariffs, and the Federal Reserve's role. Insights on potential market shifts and the impact on investments and cryptocurrencies are shared, offering a glimpse of hope amidst prevailing economic uncertainties.

Unveiling Cryptocurrency Success Illusions: Survivorship Bias, Social Media, and FOMO

Lark Davis debunks cryptocurrency success myths: Survivorship bias distorts reality; social media magnifies illusions; FOMO clouds judgment. True success lies in personal goals and perseverance.

2025 Crypto Trends: Altcoin ETFs, Ethereum Staking, Real Assets, and AI Comeback

In 2025, key crypto narratives include Dino coins eyeing altcoin ETFs, Ethereum's ETF staking feature, rising real-world assets, and the potential comeback of AI coins. Strategic positioning is essential for maximizing investment opportunities in the evolving crypto market landscape.