Institutional OTC Crypto Trading Surge: Wintermute Report 2024 Insights

- Authors

- Published on

- Published on

In the high-octane world of crypto trading, institutional players are making waves, not by splashing around in the public markets like the rest of us, but by diving deep into the secretive realm of private OTC trading. Wintermute, a heavyweight market maker in the crypto space, has pulled back the curtain on this shadowy world, revealing a staggering quadrupling of OTC trading volumes in 2024. This explosive growth, fueled by major events like the SEC's nod to Bitcoin ETFs and Donald Trump's return to the spotlight, has sent shockwaves through the market, setting new all-time highs and reshaping the landscape of institutional crypto trading.

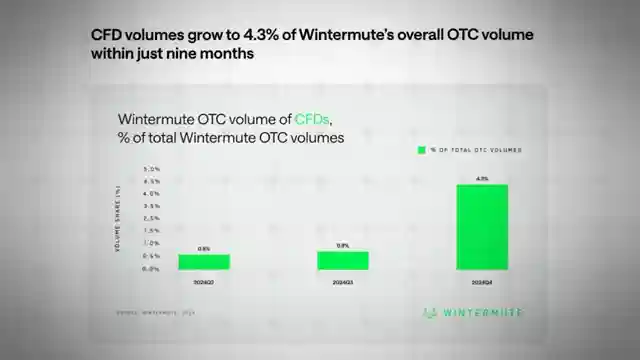

As Wintermute's report lays bare the shifting tides of institutional trading, we witness a surge in demand for crypto assets, with institutions making bolder moves and larger bets. The rise of meme coins, led by the likes of Doge and Shiba, has captured the attention of these big players, reshaping the composition of trading volumes and signaling a movement towards riskier assets. Wintermute's foray into derivatives, particularly leveraged CFD products, reflects this hunger for amplified exposure to the crypto market, with BTC dominating the scene and Ethereum making a surprising entrance.

Looking ahead, Wintermute's crystal ball reveals tantalizing predictions for the future of crypto, from the US potentially creating a strategic Bitcoin reserve to a listed corporation eyeing Ethereum for a major acquisition. The stage is set for a thrilling year in crypto, with institutional players poised to make bold moves and reshape the market in their image. Wintermute's insights offer a glimpse into the high-stakes world of institutional crypto trading, where fortunes are made and lost in the blink of an eye. As the crypto market hurtles towards an uncertain future, one thing is clear: the game is changing, and Wintermute is at the forefront of this exhilarating transformation.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch The $2 Billion Crypto Trade No One Saw Coming: OTC Report on Youtube

Viewer Reactions for The $2 Billion Crypto Trade No One Saw Coming: OTC Report

"Institutional meme coin portfolios" was not on my 2025 bingo card

Wintermute manipulated the market with Binance and Coinbase

Can you guarantee to never get rich in crypto again?

Anyone made any money from the information on this channel?

Is the price of Bitcoin not based on the spot market anymore?

How can whales push the price to the sky?

Nobody touches Ethereum now after the big dump last week

Wintermute creating their own narrative in cahoots with whales

BTC will have to drop massively for retail to start selling all their BTC

Institutions have somewhere else to play that benefits only them

Related Articles

Trump's Crypto Policies: Market Impact and Future Insights

Explore the impact of Trump's crypto policies in the US on the market. Learn about the strategic Bitcoin reserve, digital asset stockpile, and the potential for global crypto integration. Exciting insights into the future of cryptocurrency!

Unveiling the PayPal Mafia: Tech Titans, Politics, and Controversies

Discover the powerful influence of the PayPal Mafia on tech, politics, and the Trump Administration. Learn about key figures like Peter Thiel, Elon Musk, and David Sacks, their impact, and the controversies surrounding their involvement. Explore the intersection of tech, finance, and politics with the PayPal Mafia.

Upcoming Crypto IPOs: Circle, Kraken, Animoka Brands & More

Explore upcoming crypto IPOs with Coin Bureau: Circle, Kraken, Animoka Brands, Bullish Global, and Chain Analysis. Get insights into these game-changing companies set to shake up the financial market.

Unveiling the Potential: Retail Investors, Altcoins, and the Crypto Super Cycle

Coin Bureau explores the impact of retail investors on altcoins and the potential for a crypto super cycle. They debunk misconceptions, highlight exponential retail adoption growth, and predict increased investment in accessible cryptos on efficient blockchains like Solana. Institutions focus on utility-driven cryptos, while web 3 projects linked to gaming and social finance are poised for explosive growth. The next growth frontier lies in actual crypto adoption, with millions of active users driving industry disruption.