Global Crypto Adoption Survey: Key Insights Revealed

- Authors

- Published on

- Published on

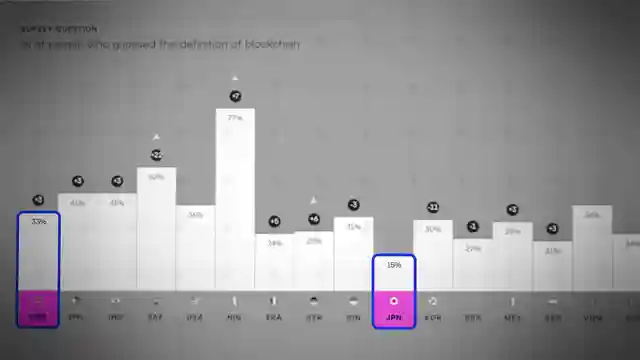

In this exhilarating exposé by Coin Bureau, we dive headfirst into the thrilling world of global crypto adoption. The team uncovers jaw-dropping insights from a recent survey orchestrated by the mighty ConsenSys, involving a whopping 20,000 individuals spread across 18 countries. It's like a high-octane race, with each nation vying for pole position in blockchain literacy. Nigeria emerges as the Lewis Hamilton of the group, leaving competitors in the dust with its stellar understanding of blockchain technology. On the flip side, countries like Japan and the UK seem to have taken a wrong turn, lagging behind in the crypto knowledge Grand Prix.

As the adrenaline-fueled survey unfolds, the team revs up the engines to explore public perceptions of blockchain's utility in tackling AI-related risks like fake news. It's a nail-biting showdown as different nations reveal their confidence levels in blockchain technology. While some countries roar with optimism, others, like Germany, hit the brakes hard, showcasing a skeptical stance towards the crypto realm. The drama unfolds further as the survey delves into the riveting world of crypto wallet ownership, with Nigeria once again zooming ahead as the undisputed champion in wallet adoption.

But hold onto your seats, because the rollercoaster ride doesn't stop there. The survey uncovers a surge in crypto ownership across countries like Mexico, the Philippines, South Africa, Germany, and Japan, signaling a seismic shift in global investment trends. The team uncovers a treasure trove of data, revealing the ever-evolving landscape of crypto adoption, shaped by factors like cultural attitudes, economic conditions, and the relentless march of technological progress. It's a wild ride through the twists and turns of the crypto world, where each revelation leaves you on the edge of your seat, hungry for more. So buckle up, crypto enthusiasts, because the Coin Bureau has just taken you on a heart-pounding journey through the fast and furious world of global crypto adoption.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Global Crypto Adoption is Exploding – But NOT Where You’d Expect! on Youtube

Viewer Reactions for Global Crypto Adoption is Exploding – But NOT Where You’d Expect!

South Africa's adoption of crypto due to governance issues and high unemployment

Kenya's early adoption of virtual banking system

Nigeria's dominance in crypto due to economic downturn and poverty

Nigeria being supportive of education and building a robust economy

Argentina's increasing interest in crypto

Citizen distrust of governments leading to interest in cryptocurrencies

Comments on El Salvador's absence in the discussion

Mistrust of government currency as a main reason for African and South American interest in crypto

Speculation on Litecoin exceeding $400 in a year

Concerns about the impact of blockchain technology on AI and fake news

Related Articles

Trump's Crypto Policies: Market Impact and Future Insights

Explore the impact of Trump's crypto policies in the US on the market. Learn about the strategic Bitcoin reserve, digital asset stockpile, and the potential for global crypto integration. Exciting insights into the future of cryptocurrency!

Unveiling the PayPal Mafia: Tech Titans, Politics, and Controversies

Discover the powerful influence of the PayPal Mafia on tech, politics, and the Trump Administration. Learn about key figures like Peter Thiel, Elon Musk, and David Sacks, their impact, and the controversies surrounding their involvement. Explore the intersection of tech, finance, and politics with the PayPal Mafia.

Upcoming Crypto IPOs: Circle, Kraken, Animoka Brands & More

Explore upcoming crypto IPOs with Coin Bureau: Circle, Kraken, Animoka Brands, Bullish Global, and Chain Analysis. Get insights into these game-changing companies set to shake up the financial market.

Unveiling the Potential: Retail Investors, Altcoins, and the Crypto Super Cycle

Coin Bureau explores the impact of retail investors on altcoins and the potential for a crypto super cycle. They debunk misconceptions, highlight exponential retail adoption growth, and predict increased investment in accessible cryptos on efficient blockchains like Solana. Institutions focus on utility-driven cryptos, while web 3 projects linked to gaming and social finance are poised for explosive growth. The next growth frontier lies in actual crypto adoption, with millions of active users driving industry disruption.