Decoding Bitcoin Market Cycles: Trends, Halving Events, and Future Implications

- Authors

- Published on

- Published on

In this thrilling episode of Lark Davis, we dive headfirst into the heart-pounding world of Bitcoin market cycles. Picture this: a high-octane four-year cycle featuring intense phases like the bear market, recovery, and the adrenaline-pumping bull market leading to a mind-blowing blowoff top. It's like a rollercoaster ride through the financial jungle, with each turn more exhilarating than the last. And what fuels this white-knuckle journey, you ask? The legendary Bitcoin halving event, a mystical occurrence that slashes block rewards and sends shockwaves through the market.

But hold on to your seats, folks, because this time around, the game has changed. We're witnessing a shift in the crypto cosmos, with money flowing into new frontiers like Solana and meme coins, bypassing the traditional altcoin season. The once-predictable cycle is now a wild, untamed beast, leaving experts and enthusiasts alike on the edge of their seats. Will Bitcoin continue its meteoric rise, or are we in for a heart-stopping plot twist that no one saw coming?

As the market hurtles through twists and turns, one thing is clear: the future of Bitcoin cycles hangs in the balance. With the landscape evolving and new players entering the arena, the old rules may no longer apply. It's a high-stakes game of strategy and speculation, where only the bold and the savvy will emerge victorious. So buckle up, gearheads, because the race towards the next phase of the Bitcoin market cycle is on, and the finish line promises to be nothing short of electrifying.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Bitcoin Market Cycles Explained on Youtube

Viewer Reactions for Bitcoin Market Cycles Explained

Some users are expressing frustration with the repetitive content and sponsored plugs in the videos

Comments on potential market movements and predictions

Appreciation for the informative content and educational aspect of the videos

Specific mentions of gains made in the crypto market

Concerns about Bitcoin's future and potential risks

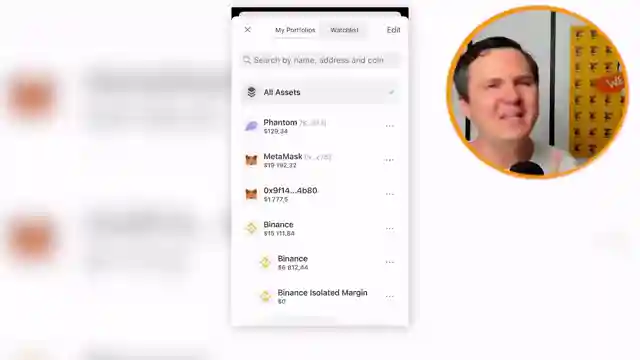

Requests for specific guidance on transferring funds between wallets

Criticism of the video content being filled with sponsored content and lacking valuable information

Observations on market sentiment and strategies for trading

Speculation on the current state of the market and potential outcomes

Comments on the current state of Bitcoin and potential risks related to UTXO consolidations in the BTC Mempool

Related Articles

Adapting to the New Era: Navigating Crypto's Evolution

Lark Davis explores the evolving crypto landscape, signaling the end of easy gains. Investors must adapt to Wall Street influence, seek new opportunities like humanoid robotics, and embrace strategic profit-taking in a maturing market.

2025 Market Forecast: Tax Cuts, Tariffs, and Crypto Insights

Lark Davis explores the 2025 market outlook, discussing tax cuts, tariffs, and the Federal Reserve's role. Insights on potential market shifts and the impact on investments and cryptocurrencies are shared, offering a glimpse of hope amidst prevailing economic uncertainties.

Unveiling Cryptocurrency Success Illusions: Survivorship Bias, Social Media, and FOMO

Lark Davis debunks cryptocurrency success myths: Survivorship bias distorts reality; social media magnifies illusions; FOMO clouds judgment. True success lies in personal goals and perseverance.

2025 Crypto Trends: Altcoin ETFs, Ethereum Staking, Real Assets, and AI Comeback

In 2025, key crypto narratives include Dino coins eyeing altcoin ETFs, Ethereum's ETF staking feature, rising real-world assets, and the potential comeback of AI coins. Strategic positioning is essential for maximizing investment opportunities in the evolving crypto market landscape.