Decoding Bitcoin Market Cycles: Past Trends and Future Insights

- Authors

- Published on

- Published on

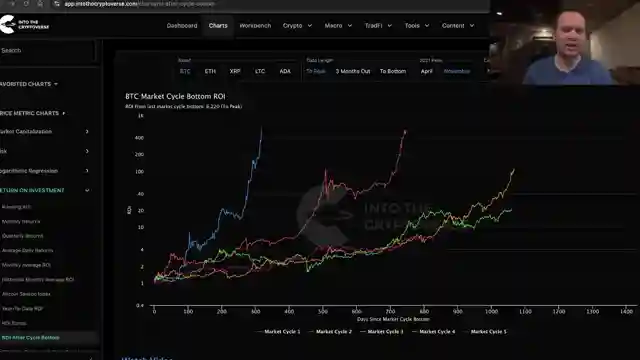

In this riveting analysis by Benjamin Cowen, the enigmatic world of Bitcoin Market Cycles is dissected with surgical precision. Cowen delves into the intricate details of comparing the current cycle with its predecessors, scrutinizing the Return on Investment (Roi) from the market cycle bottom. Drawing parallels between the ongoing cycle and the 2016-2017 and 2019-2021 cycles, Cowen uncovers both deviations and similarities in market structure, offering a tantalizing glimpse into the potential trajectory of Bitcoin's market cycle.

The discussion escalates as Cowen highlights the implications of the running one-year Roi dipping below 2x, hinting at the critical juncture Bitcoin finds itself in. By examining Roi as measured from the having and Peak to Peak comparisons, Cowen paints a vivid picture of the potential future Roi trends, hinting at both challenges and opportunities on the horizon. The significance of the 100-day moving average emerges as a crucial factor in understanding Bitcoin's historical patterns and contemplating the various scenarios that could unfold in the ever-evolving landscape of cryptocurrency.

With an air of anticipation, Cowen navigates through the complexities of Bitcoin's Roi, shedding light on the intricate dance between past cycles and the current market dynamics. As the analysis unfolds, viewers are taken on a rollercoaster ride of insights and projections, with each revelation adding a new layer of depth to the enigma that is Bitcoin Market Cycles. Through Cowen's expert analysis and keen observations, the audience is left with a sense of awe and curiosity, eagerly awaiting the next twist in the tumultuous journey of Bitcoin's market evolution.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Bitcoin Market Cycles on Youtube

Viewer Reactions for Bitcoin Market Cycles

Beware of fake Ben scam bots and report all scams

Regret over not investing in Bitcoin earlier

Appreciation for detailed information shared by Ben

Speculation on market trends and cycles

Request for video on BTC risk metrics

Hope for BTC to break up sooner

Concerns about potential bear market lows for BTC

Speculation on potential impact of federal layoffs on the market

Appreciation for Ben's insights and outlook on the market

Questioning the cyclical nature of Bitcoin and its correlation to the stock market

Related Articles

FED's Quantitative Tightening Adjustment: Impacts on Markets and Bitcoin Pairs

Benjamin Cowen analyzes the FED's decision to ease quantitative tightening, reducing Treasury Securities cap. Insights on market trends and potential impacts on Bitcoin pairs provide a roadmap for investors navigating economic shifts.

Bitcoin Pre-FOMC Analysis: Fed's Quantitative Tightening Impact

Benjamin Cowen analyzes Bitcoin's performance pre-FOMC, focusing on potential end of balance sheet runoff, Fed's quantitative tightening, and market trends.

Decoding Bitcoin's RSI Trends and Market Impact: Insights by Benjamin Cowen

Benjamin Cowen analyzes Bitcoin's RSI trends, historical data, and the impact of monetary policies on market performance, offering insights for strategic decision-making in the cryptocurrency landscape.

Bitcoin Analysis: Bull Market Support Band Trends and Predictions

Benjamin Cowen analyzes Bitcoin's position below the bull market support band, comparing it to previous cycles and discussing the impact of Federal Reserve policies. He predicts potential market movements based on historical trends and external factors, offering insights into Bitcoin's future performance.