Decoding Bitcoin Market Cycles: Insights from Historical Trends

- Authors

- Published on

- Published on

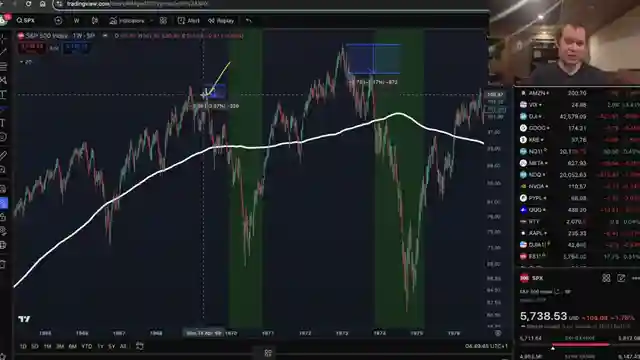

In this riveting episode, Benjamin Cowen takes us on a thrilling journey through the tumultuous world of Bitcoin and Market Cycle Theory. With the precision of a seasoned race car driver, Cowen navigates the complex terrain of market cycles, shedding light on the intriguing dynamics at play. Drawing parallels between Bitcoin and the stock market, he masterfully dissects the concept of right translated versus left translated cycles, unraveling the mysteries behind these phenomena.

Cowen's analysis reveals a pattern of right translated cycles in Bitcoin, characterized by a three-year bull market followed by a one-year bear market. Through a captivating narrative, he showcases how historical stock market cycles align with Bitcoin's trajectory, emphasizing the significance of major lows occurring in midterm years. By delving into the impact of inflation and unemployment rates on market cycles, Cowen provides a comprehensive understanding of the factors driving left translated cycles.

The discussion takes a thrilling turn as Cowen explores the role of the yield curve in predicting recessions, offering valuable insights into the risks looming over the market. With the finesse of a seasoned daredevil, he guides viewers through the treacherous waters of portfolio management in uncertain market conditions, underscoring the importance of strategic navigation. As the episode unfolds, Cowen paints a vivid picture of Bitcoin's current cycle, offering key insights into potential corrections and critical levels to monitor, keeping viewers on the edge of their seats.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Bitcoin Market Cycles: Right Translated or Left Translated? on Youtube

Viewer Reactions for Bitcoin Market Cycles: Right Translated or Left Translated?

Viewer appreciates Ben's straightforward and factual approach to discussing crypto

Discussion on decoupling of crypto from traditional finance and influence of institutions

Viewer expresses relief in longer videos by Ben

Speculation on whether the market cycle has topped

Viewer grateful for Ben's insights preventing them from becoming an "altcoin zombie"

Concerns about holding only altcoins and hoping for the best

Appreciation for Ben discussing downside risks and different outcomes

Viewer praises Ben for not always following the mainstream narrative

Viewer requests a 1-hour video on ADA

Discussion on the history of the dollar being linked to gold

Related Articles

FED's Quantitative Tightening Adjustment: Impacts on Markets and Bitcoin Pairs

Benjamin Cowen analyzes the FED's decision to ease quantitative tightening, reducing Treasury Securities cap. Insights on market trends and potential impacts on Bitcoin pairs provide a roadmap for investors navigating economic shifts.

Bitcoin Pre-FOMC Analysis: Fed's Quantitative Tightening Impact

Benjamin Cowen analyzes Bitcoin's performance pre-FOMC, focusing on potential end of balance sheet runoff, Fed's quantitative tightening, and market trends.

Decoding Bitcoin's RSI Trends and Market Impact: Insights by Benjamin Cowen

Benjamin Cowen analyzes Bitcoin's RSI trends, historical data, and the impact of monetary policies on market performance, offering insights for strategic decision-making in the cryptocurrency landscape.

Bitcoin Analysis: Bull Market Support Band Trends and Predictions

Benjamin Cowen analyzes Bitcoin's position below the bull market support band, comparing it to previous cycles and discussing the impact of Federal Reserve policies. He predicts potential market movements based on historical trends and external factors, offering insights into Bitcoin's future performance.