Decoding Bitcoin Dominance Surge: Altcoins, Monetary Policy, and Investment Insights

- Authors

- Published on

- Published on

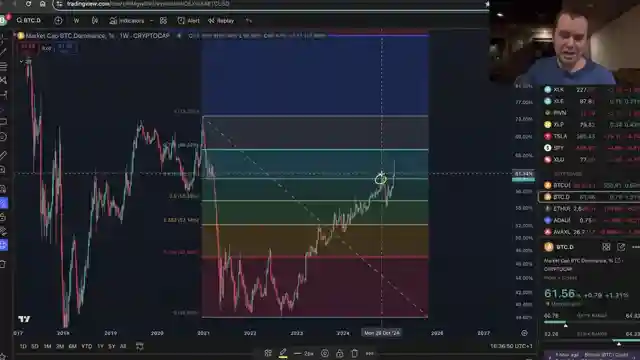

Today on Benjamin Cowen's channel, we delve into the thrilling world of Bitcoin dominance. Like a powerful beast, Bitcoin dominance has surged to a new cycle high of around 64%, reclaiming its position on a familiar trend line. This rise is not just a mere coincidence, but a direct result of the unyielding nature of monetary policy, which has remained unchanged. As we dissect the data, a clear pattern emerges - Bitcoin dominance continued to climb during the Fed's quantitative tightening phase, only showing signs of weakness when the policy shifted to quantitative easing. This correlation underscores the significant impact of monetary policies on the crypto market landscape.

In the realm of altcoins, they are portrayed as mere oscillators in the grand scheme of things, especially when compared to the mighty Bitcoin. The relationship between altcoins and Bitcoin is akin to a dance within an expanding wedge pattern, hinting at potential market movements. Historical support and resistance levels for altcoin market caps relative to Bitcoin reveal crucial insights, with key levels at 0.25 and parity being critical touchpoints. The notion of altcoins being oscillators at best is further explored through a technical lens, showcasing a trend of lower highs and lows that could shape future market dynamics.

Furthermore, the discussion shifts to the role of Bitcoin in mitigating downside risks during periods of quantitative tightening, making it a favorable choice for investors seeking stability. The narrative of Bitcoin dominance becomes even more compelling when viewed through the lens of monetary policy changes, highlighting its resilience in the face of market fluctuations. The analysis extends to the Bitcoin dominance plus stablecoins metric, which has reached significant levels and offers valuable insights into market trends. By excluding Ethereum dominance from the equation and focusing on support-turned-resistance levels in the Bitcoin dominance plus stablecoins metric, a clearer picture of market dynamics emerges, setting the stage for informed investment decisions.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Bitcoin Dominance Hits 64% on Youtube

Viewer Reactions for Bitcoin Dominance Hits 64%

Ben's analysis on Bitcoin dominance and altcoins

Mention of ETH's performance

Comments praising Ben's insights and analysis skills

Discussion on the potential drop in altcoin prices

Reference to fake Ben scam bots

Comparison between ETH and BTC

Concerns about the future of altcoins

Appreciation for Ben's content and learning experience

Request for a summary of the video

Comparison between Eth/btc and btc.d

Related Articles

FED's Quantitative Tightening Adjustment: Impacts on Markets and Bitcoin Pairs

Benjamin Cowen analyzes the FED's decision to ease quantitative tightening, reducing Treasury Securities cap. Insights on market trends and potential impacts on Bitcoin pairs provide a roadmap for investors navigating economic shifts.

Bitcoin Pre-FOMC Analysis: Fed's Quantitative Tightening Impact

Benjamin Cowen analyzes Bitcoin's performance pre-FOMC, focusing on potential end of balance sheet runoff, Fed's quantitative tightening, and market trends.

Decoding Bitcoin's RSI Trends and Market Impact: Insights by Benjamin Cowen

Benjamin Cowen analyzes Bitcoin's RSI trends, historical data, and the impact of monetary policies on market performance, offering insights for strategic decision-making in the cryptocurrency landscape.

Bitcoin Analysis: Bull Market Support Band Trends and Predictions

Benjamin Cowen analyzes Bitcoin's position below the bull market support band, comparing it to previous cycles and discussing the impact of Federal Reserve policies. He predicts potential market movements based on historical trends and external factors, offering insights into Bitcoin's future performance.