DataDash: Nicholas Merton Critiques US Crypto Reserve Inclusion

- Authors

- Published on

- Published on

Today on DataDash, Nicholas Merton delves into the controversial topic of the US crypto strategic Reserve, raising eyebrows with the proposed addition of xrp, solana, and Ada alongside Bitcoin and ethereum. Merton warns viewers about the market's unpredictability and advises against hasty trading decisions, advocating for patience and clear trend identification before making moves. He praises fellow traders Cassie and Paul for their insightful analysis techniques involving Fibonacci retracements and RSI, urging viewers to follow their work for a deeper understanding of market dynamics.

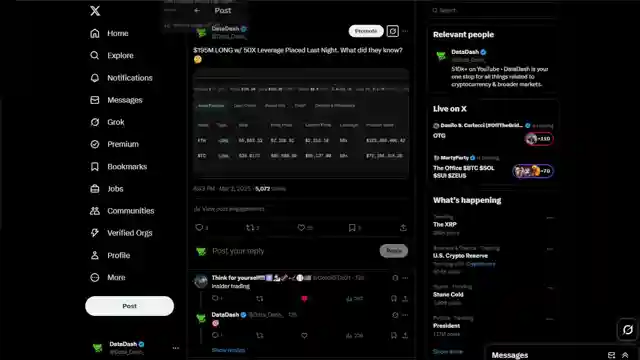

In a fiery tirade, Merton criticizes the rushed nature of the Reserve announcement, suspecting insider trading shenanigans and slamming the inclusion of seemingly random altcoins like xrp and Ada. He questions the strategic value of these assets, drawing parallels to buying shares of companies like Apple or Nvidia for national security reasons. Merton pulls no punches in condemning what he perceives as corruption and manipulation in the decision-making process, calling for a more critical examination of the situation irrespective of political leanings.

Despite the short-term price fluctuations driven by the Reserve news, Merton remains steadfast in his belief in Bitcoin's long-term resilience, asserting that the industry may undergo significant changes in the future. He cautions against overlooking the potential consequences of the Reserve's actions and urges viewers to maintain a vigilant eye on the evolving crypto landscape. Merton's impassioned plea for a more transparent and ethical approach to crypto investments resonates with viewers, sparking a necessary conversation about the integrity of decision-making in the digital asset space.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch We Need To Talk About The Bitcoin Strategic Reserve | The Brutal Reality... on Youtube

Viewer Reactions for We Need To Talk About The Bitcoin Strategic Reserve | The Brutal Reality...

Concerns about the government's involvement in crypto and the potential for corruption

Criticism of the administration's handling of crypto and accusations of enriching themselves

Discussion on the strategic reserve of ADA and its implications for governance

Skepticism about the timing and choice of cryptos mentioned in the announcement

Criticism of using tax dollars to buy crypto

Debate on the legitimacy and real use cases of cryptocurrencies

Speculation on potential corruption and manipulation in the crypto market

Comparison to China's strategic reserves in the past

Support for XRP and its partnerships with American Express and Bank of America

Personal opinions on the channel's content and views on various cryptocurrencies

Related Articles

Unveiling the Economic Crisis: Private Equity's Threat to Businesses and Retirement Savings

DataDash uncovers a hidden crisis in the economy caused by private Equity firms' risky debt practices, threatening businesses and retirement savings. Learn how to protect your financial future in the face of this looming threat.

Crypto Market Update: CME Solana Futures, XRP Lawsuit, Fed Meeting Impact

DataDash covers CME's Solana Futures, XRP lawsuit drop, Fed meeting impact, Q1 end, and Trump's tariff proposal. Bitcoin and Ethereum price analysis, Sui's traction, and key levels are discussed for potential market movements.

Crypto Market Update: Stable Coin Regulations, Binance Delisting, and XRP Surge

The crypto market faces upheaval with stable coin regulations, Binance delisting Tether, and XRP's regulatory clarity. Bitcoin eyes $95,000, XRP targets $3.80 resistance, signaling market shifts ahead.

Satoshi Nakamoto Identity: Is Jack Dorsey the Real Creator of Bitcoin?

Unraveling the mystery of Bitcoin's creator: Could Jack Dorsey be Satoshi Nakamoto? Explore the compelling evidence and contradictions in this intriguing investigation.