Cryptocurrency Market Analysis: Inflation, Quantitative Easing, and Altcoin Trends

- Authors

- Published on

- Published on

Today on Lark Davis, we dive headfirst into the murky waters of inflation, quantitative easing, and the thrilling rollercoaster ride of market reactions. Goldman Sachs predicts a 3% surge, while Bank of America plays it safe at 2.8%, with the majority expecting a 2.9% outcome. Surprisingly, many major companies are shrugging off inflation concerns, painting a rosier picture for the future. True inflation numbers are showing a lower rate than anticipated, hinting at potential market shifts ahead. Bond yields are poised to follow the downward trajectory of inflation, signaling a possible silver lining for investors.

As we navigate the choppy seas of economic uncertainty, the enigmatic figure of quantitative easing emerges. It's a tool reserved for financial crises, a last resort when rates hit rock bottom. The Global M2 supply is on an upward trajectory, injecting liquidity into the system until 2026. But let's not forget the elephant in the room – the US economy is shedding its cloak of stagnation, marching towards a brighter, more robust future. Bitcoin's price dances to the tune of the 50-day EMA, hash ribbons, and weekly RSI, painting a vivid picture of market sentiment.

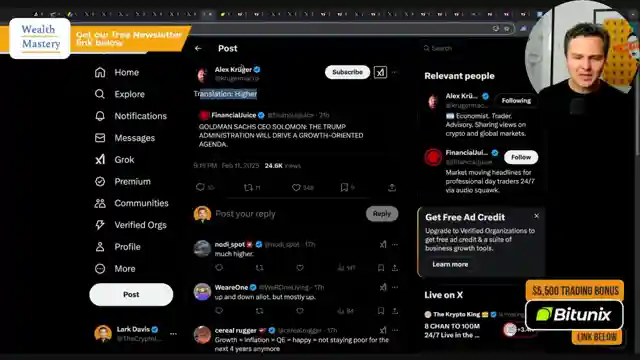

In the realm of cryptocurrencies, the SEC nods at spot ETF filings, heralding a new era for digital assets. Altcoin ETF listings loom on the horizon, promising a deluge of capital inflows. However, challenges lurk as Salana faces rejection and Fcoin mirrors market attitudes. Memes coins face a reckoning, with Popcat's chart resembling a rollercoaster ride. Altcoins show signs of outshining Bitcoin, hinting at a potential shift in market dynamics. Litecoin's rejection from the trend line raises eyebrows, leaving traders on edge before the inflation data reveal their hand.

In conclusion, the stage is set for a high-octane showdown between altcoins and Bitcoin, with market indicators pointing towards an overweighting of the former. The intricate dance between global M2 growth and altcoin performance adds a layer of complexity to the ever-evolving crypto landscape. As the market braces for potential turbulence, all eyes are on the inflation data to dictate the next move. Will the winds of change favor the bold altcoins, or will Bitcoin reassert its dominance? Only time will tell in this thrilling saga of financial intrigue and market dynamics.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch DANGER! BIG NEWS FOR CRYPTO TODAY on Youtube

Viewer Reactions for DANGER! BIG NEWS FOR CRYPTO TODAY

AI stocks, specifically NVIDIA, are expected to dominate in 2025

Bitcoin has been rising significantly

Some users have seen substantial returns on their investments

Concerns about the market crashing and being unpredictable

Mentions of specific cryptocurrencies like Moonacy protocol and Nexo

Comments on inflation data and quantitative easing

Criticisms of government handling of economic issues

Mentions of specific trading strategies and mentors

Concerns about Robinhood's limitations for transferring funds

Comments on specific cryptocurrencies like $Nexo and Popcat

Related Articles

Adapting to the New Era: Navigating Crypto's Evolution

Lark Davis explores the evolving crypto landscape, signaling the end of easy gains. Investors must adapt to Wall Street influence, seek new opportunities like humanoid robotics, and embrace strategic profit-taking in a maturing market.

2025 Market Forecast: Tax Cuts, Tariffs, and Crypto Insights

Lark Davis explores the 2025 market outlook, discussing tax cuts, tariffs, and the Federal Reserve's role. Insights on potential market shifts and the impact on investments and cryptocurrencies are shared, offering a glimpse of hope amidst prevailing economic uncertainties.

Unveiling Cryptocurrency Success Illusions: Survivorship Bias, Social Media, and FOMO

Lark Davis debunks cryptocurrency success myths: Survivorship bias distorts reality; social media magnifies illusions; FOMO clouds judgment. True success lies in personal goals and perseverance.

2025 Crypto Trends: Altcoin ETFs, Ethereum Staking, Real Assets, and AI Comeback

In 2025, key crypto narratives include Dino coins eyeing altcoin ETFs, Ethereum's ETF staking feature, rising real-world assets, and the potential comeback of AI coins. Strategic positioning is essential for maximizing investment opportunities in the evolving crypto market landscape.