China's Crypto Evolution: Strategic Bitcoin Reserve in Hong Kong

- Authors

- Published on

- Published on

In this thrilling episode, the Coin Bureau delves into the tumultuous relationship between China and cryptocurrency, with a spotlight on the intriguing possibility of a strategic Bitcoin Reserve emerging in Hong Kong. Despite China's tough stance on crypto, whispers of a potential game-changing move are reverberating through the financial realm. From Beijing's crackdowns to the persistence of retail crypto activity, the scene is set for a high-stakes showdown. The recent police raids targeting illicit foreign exchange transactions only add fuel to the fire, showcasing China's iron grip on capital controls and its keen eye on financial security.

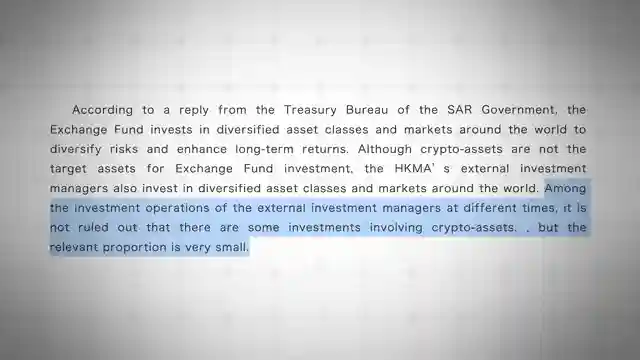

Enter the stage-stealing concept of a Strategic Bitcoin Reserve, with speculations running wild about China's potential involvement in this crypto power play. Anthony Scaramucci's bold prediction at a Bitcoin conference sets tongues wagging, hinting at China accumulating BTC as a reserve asset in the not-so-distant future. Meanwhile, the Chairman of Hong Kong's web 3 and virtual assets development subcommittee adds a new twist to the plot, advocating for Hong Kong to take the helm in piloting BTC adoption as a strategic reserve asset. The stakes are high, with National Financial Security concerns looming large and the potential for Hong Kong to carve out a pioneering role in shaping crypto policies.

As the narrative unfolds, industry associations and experts rally behind the idea of incorporating BTC into China's foreign exchange reserves, painting a picture of enhanced financial stability and risk mitigation. The evolving dynamics between Beijing and Hong Kong add an extra layer of intrigue to this crypto saga, raising questions about China's true intentions towards cryptocurrency and the broader implications of a BTC Reserve. Amidst the uncertainty and speculation, one thing is clear - the collision course between China and crypto is set to reach a thrilling climax, with the fate of financial landscapes hanging in the balance.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch China’s $75 Billion Crypto Secret Exposed: What It Means for You on Youtube

Viewer Reactions for China’s $75 Billion Crypto Secret Exposed: What It Means for You

Binance, Bybit, and OKX deals with bonuses and fee discounts

Discussion on BTC not being banned but restricted in China

BRICS countries exploring a new currency potentially backed by gold

China's hoarding of gold and potential impact on the financial system

Speculation on China's involvement in crypto and potential profits

Mention of Conflux (CFX) as China's only regulatory approved blockchain

Concerns about China accumulating BTC and profiting in the future

Debate on the value of gold compared to Bitcoin

Technical issue with transferring Solana from Kraken to a wallet

Request to stop calling Bitcoin "crypto"

Related Articles

Trump's Crypto Policies: Market Impact and Future Insights

Explore the impact of Trump's crypto policies in the US on the market. Learn about the strategic Bitcoin reserve, digital asset stockpile, and the potential for global crypto integration. Exciting insights into the future of cryptocurrency!

Unveiling the PayPal Mafia: Tech Titans, Politics, and Controversies

Discover the powerful influence of the PayPal Mafia on tech, politics, and the Trump Administration. Learn about key figures like Peter Thiel, Elon Musk, and David Sacks, their impact, and the controversies surrounding their involvement. Explore the intersection of tech, finance, and politics with the PayPal Mafia.

Upcoming Crypto IPOs: Circle, Kraken, Animoka Brands & More

Explore upcoming crypto IPOs with Coin Bureau: Circle, Kraken, Animoka Brands, Bullish Global, and Chain Analysis. Get insights into these game-changing companies set to shake up the financial market.

Unveiling the Potential: Retail Investors, Altcoins, and the Crypto Super Cycle

Coin Bureau explores the impact of retail investors on altcoins and the potential for a crypto super cycle. They debunk misconceptions, highlight exponential retail adoption growth, and predict increased investment in accessible cryptos on efficient blockchains like Solana. Institutions focus on utility-driven cryptos, while web 3 projects linked to gaming and social finance are poised for explosive growth. The next growth frontier lies in actual crypto adoption, with millions of active users driving industry disruption.