Bitcoin's Correlation with Global M2 Money Supply: Insights and Projections

- Authors

- Published on

- Published on

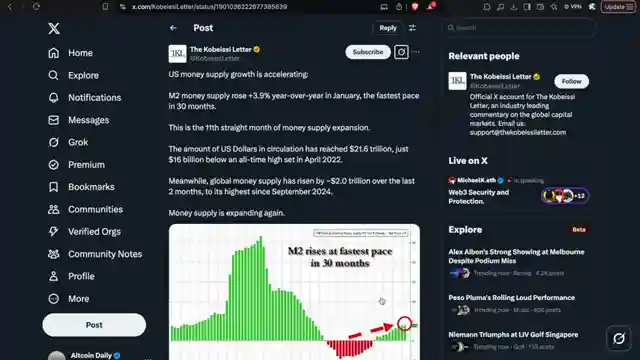

In a riveting analysis, Altcoin Daily delves into the thrilling correlation between Bitcoin and the global M2 money supply. They unveil a fascinating 82% correlation, coupled with an intriguing lag of 8-12 weeks. The M2, a complex mix of cash, savings, and other assets, has recently hit a record high, signaling a potential seismic shift in Bitcoin's trajectory. Despite occasional hiccups caused by crypto-specific events, the historical data paints a compelling picture of the intertwined fate of Bitcoin and the M2.

As the Bitcoin price languishes around $80,000, Altcoin Daily shines a spotlight on the surging M2, fueled by the rapid expansion of the US money supply and global economic dynamics. This surge not only hints at potential future movements in Bitcoin's value but also underscores the interconnectedness of global economic forces on the crypto market. By dissecting the US-China relationship and its impact on Bitcoin, Altcoin Daily urges viewers to broaden their horizons beyond domestic affairs to grasp the full scope of Bitcoin's journey.

Moreover, Altcoin Daily underscores the significance of integrating social data into the realm of altcoin tracking, exemplified by the groundbreaking partnership between Cookie and Coin Gecko. This collaboration promises real-time social analytics for AI-driven altcoins, potentially revolutionizing investment strategies in the crypto sphere. The channel also delves into the macroeconomic ramifications of US policies, offering insights into potential recession triggers and debt management tactics. Through a lens of anticipation, Altcoin Daily paints a bold projection of Bitcoin's future price, envisioning a substantial surge despite short-term market fluctuations.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Bitcoin To Hit $250,000 This Year | Macro Expert on Youtube

Viewer Reactions for Bitcoin To Hit $250,000 This Year | Macro Expert

Speculative nature of Bitcoin price predictions

Doubts about accuracy of analysts and influencers' forecasts

Skepticism towards promotion of certain coins

Disagreement on potential price targets for Bitcoin

Criticism of financial experts and their predictions

Mention of specific cryptocurrencies like XAI14D, MATIC, ETH, DOGE, SOL, ADA, HBAR, AIOZ

Comments on potential market manipulation and FOMO

Mention of specific individuals like Raoul Pal and Arthur Hayes

Discussion on potential future price levels for Bitcoin (e.g., $220k, $250k, $150k)

Reference to upcoming events like the Bitcoin Conference 2025

Related Articles

Bitcoin 2025 Forecast: Institutional Adoption, US Government Purchase, and Regulatory Updates

2025 brings institutional adoption of Bitcoin, Black Rock's Robbie Mitchnik predicts its future. Altcoin Daily discusses market trends, potential US government Bitcoin purchase, and regulatory changes. Stay informed with daily updates.

Unveiling Crypt Mo: Crypto Trading Wizardry

Discover the crypto trading prowess of Crypt Mo, a hidden gem with accurate price predictions and insider insights. Altcoin Daily recommends subscribing for valuable trading tips and market analysis. Join the crypto success journey today!

US Bitcoin Reserve & Global Crypto Trends: ECB Digital Currency, Solana Smartphone & Xborg Rewards

US establishes Strategic Bitcoin Reserve, sparking global interest. European Central Bank pushes for digital currency. Ethereum ETFs face challenges, Solana unveils crypto-compatible smartphone. Xborg offers rewards for crypto gaming. Exciting times ahead in the world of digital assets!

US Crypto Revolution: SEC Drops Ripple Case, Trump's Support, Banks Prepare

The US accelerates as a crypto powerhouse with pro-crypto regulations and Trump's support. SEC drops Ripple case, paving the way for Bitcoin and Ethereum advancements. Banks prepare for crypto custody and payments, signaling a major shift in the financial industry. Exciting times ahead for the crypto market!