Bitcoin Supply Crisis Unveiled: Exchange Trends, ETF Adoption, and Nation-State Influence

- Authors

- Published on

- Published on

In this riveting episode by Lark Davis, we delve into the heart of the Bitcoin Supply crisis. It's like a high-stakes poker game with the Exchange and OTC data showing a dwindling supply of Bitcoin. The numbers are staggering - only 150,000 Bitcoin left on OTC desks, a mere drop in the ocean for the crypto world. But don't be fooled by the seemingly small amount, as when these buyers strike, the market will feel the tremors.

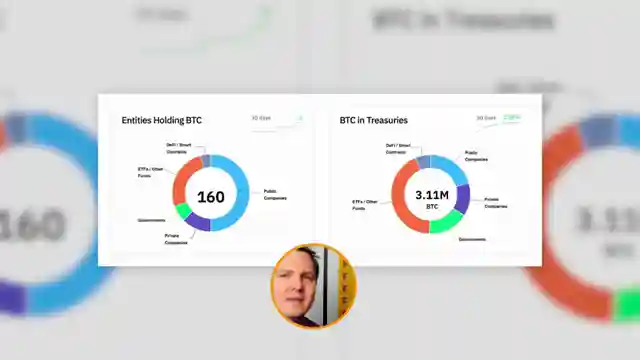

The adoption metrics for ETFs and public companies are through the roof, with entities like MicroStrategy leading the charge. They've been hoovering up Bitcoin like there's no tomorrow, setting the stage for a potential price explosion. Public companies worldwide are catching on, with 77 of them now holding Bitcoin on their balance sheets. It's a domino effect - one company buys, the next one follows, and soon enough, the whole world is paying attention.

And let's not forget the looming presence of nation-states in the Bitcoin arena. The US, in particular, is poised to make a strategic move by establishing a Bitcoin Reserve. The prospect of Trump getting involved adds a layer of intrigue, with senators and bipartisan support hinting at a seismic shift in the crypto landscape. The stage is set for a showdown of epic proportions, with Bitcoin at the center of it all.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch An Insane Bitcoin Supply Crisis is Coming on Youtube

Viewer Reactions for An Insane Bitcoin Supply Crisis is Coming

Viewers are discussing the ongoing Bitcoin supply crisis and its impact on the market

Some viewers express frustration with the repetitive nature of the content

Others appreciate the clear and concise communication in the videos

There are comments on the potential for individual states to create a supply crunch

Mention of the need for an altcoin season

Some viewers express frustration with the current state of Bitcoin and altcoins

A viewer mentions the potential tie between Bitcoin and equities

A comment on Bitcoin being perceived as a Ponzi scheme

Mention of a retirement strategy involving Bitcoin investment

A viewer predicts a specific price range for Bitcoin in the future

Related Articles

Adapting to the New Era: Navigating Crypto's Evolution

Lark Davis explores the evolving crypto landscape, signaling the end of easy gains. Investors must adapt to Wall Street influence, seek new opportunities like humanoid robotics, and embrace strategic profit-taking in a maturing market.

2025 Market Forecast: Tax Cuts, Tariffs, and Crypto Insights

Lark Davis explores the 2025 market outlook, discussing tax cuts, tariffs, and the Federal Reserve's role. Insights on potential market shifts and the impact on investments and cryptocurrencies are shared, offering a glimpse of hope amidst prevailing economic uncertainties.

Unveiling Cryptocurrency Success Illusions: Survivorship Bias, Social Media, and FOMO

Lark Davis debunks cryptocurrency success myths: Survivorship bias distorts reality; social media magnifies illusions; FOMO clouds judgment. True success lies in personal goals and perseverance.

2025 Crypto Trends: Altcoin ETFs, Ethereum Staking, Real Assets, and AI Comeback

In 2025, key crypto narratives include Dino coins eyeing altcoin ETFs, Ethereum's ETF staking feature, rising real-world assets, and the potential comeback of AI coins. Strategic positioning is essential for maximizing investment opportunities in the evolving crypto market landscape.