Bitcoin Recovery Post-Trump: Market Stability, Global Reserves & Institutional Interest

- Authors

- Published on

- Published on

In this episode of CryptosRUs, we witness Bitcoin's dramatic v-shaped recovery following a nosedive triggered by Trump's executive order on the Bitcoin reserve. Despite a shaky start, the US market holds steady amidst lower job additions, with all eyes on Bitcoin's strategic reserve and digital asset stockpile. Michael Saylor swoops in with ingenious budget-neutral strategies for the US to acquire Bitcoin, hinting at the possibility of issuing bonds for this purpose. The White House Summit, graced by heavyweights like Saylor, promises potential game-changing announcements that could shake the very foundations of the crypto world.

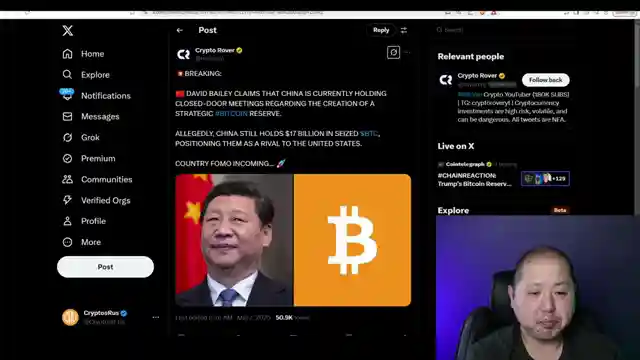

Meanwhile, over in China, a strategic Bitcoin reserve is in the works, mirroring the US's bold move in the crypto space. Countries across the globe, from the US to China, UK, Ukraine, Bhutan, and El Salvador, are amassing significant Bitcoin reserves, with Brian Armstrong boldly predicting that the G20 nations will soon follow suit. Despite lingering market volatility and uncertainty, the influx of institutional buyers signals a promising future for Bitcoin and the wider crypto landscape. It's a wild ride, but staying the course amidst the chaos is key, as global adoption of crypto and blockchain technologies continues to gain momentum.

As the crypto world hurtles forward, it's essential to keep a keen eye on the horizon and resist the urge to succumb to fear, uncertainty, and doubt. The tides are turning, with countries, banks, and financial institutions worldwide embracing the crypto revolution. So, buckle up, stay resilient, and brace yourself for the thrilling twists and turns that lie ahead in the ever-evolving realm of cryptocurrency. And remember, in this fast-paced world of crypto, only the bold and steadfast will emerge victorious.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch What To Expect From White House Crypto Summit on Youtube

Viewer Reactions for What To Expect From White House Crypto Summit

Summit expectations

George's health

Market crashes and volatility

Government actions on gold and BTC

Portfolio performance

Diversification strategies

Trump administration's impact on crypto

SONY78K token discussion and potential

Elon Musk's influence

Educational content and community support

Related Articles

Unveiling Howard Lutnik's Influence: Trump's Economic Vision & Crypto Revolution

Explore the impact of Howard Lutnik's interview on Trump's economic policies and the crypto market. Discover how strategic collaborations and visionary appointments are shaping the future of finance.

Crypto Round Table, Ripple's Win, Institutional Bitcoin Interest & Trump's Stable Coin Support

CryptosRUs discusses SEC's crypto round table, Ripple's legal win, institutional interest in Bitcoin, and Trump's support for stable coins. Exciting insights into the evolving crypto landscape.

Trump Backs Bitcoin: Tether's Move and SEC's Rulings Signal Crypto Optimism

CryptosRUs analyzes Trump's support for Bitcoin and stable coins, Tether's US treasuries purchase, and the SEC's stance on Bitcoin and mining. Positive regulatory shifts signal a bright future for crypto despite market volatility.

CryptosRUs: Trump's Crypto Conference Message & Bitcoin Resilience

CryptosRUs explores President Trump's message at a crypto conference and the impact of potential Fed rate cuts on inflation. States creating Bitcoin reserves amid market uncertainty. Anticipated announcement at digital asset Summit with Trump's recorded appearance. Bitcoin remains strong in the red market.