Bitcoin Price Analysis: Supply-Demand Dynamics & Institutional Inflows

- Authors

- Published on

- Published on

Today, Nicholas Merton, the man behind DataDash, takes us on a thrilling ride through the tumultuous world of Bitcoin on February 10th, 2025. Buckle up, ladies and gentlemen, as we dive headfirst into the heart of the matter - the sideways shuffle of Bitcoin post a roaring rally from September to December. Merton, ever the vigilant observer, reminds us that these consolidation phases are as common as a cup of tea in England after a grand victory. He sheds light on the psychological barriers that dictate market sentiment, urging us to pay heed to the ebbs and flows of buyer and seller dynamics.

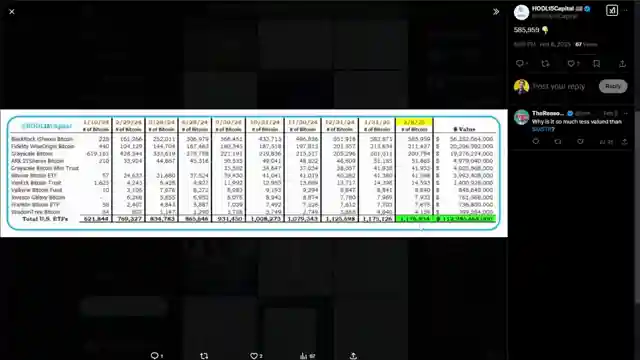

In his signature style, Merton dissects the intricate dance between supply and demand, particularly focusing on the influx of institutional capital into the crypto sphere. With a keen eye on ETF flows and the monumental role played by MicroStrategy in Bitcoin accumulation, he paints a vivid picture of the market forces at play. The mention of MicroStrategy's strategic issuance of convertible notes to fuel their Bitcoin buying spree adds a layer of intrigue to the narrative, akin to a plot twist in a blockbuster movie.

As the plot thickens, Merton navigates through the treacherous waters of technical analysis, pointing towards moving averages as the compass guiding Bitcoin's trajectory. The looming threat of breaching critical support levels sets the stage for a high-stakes showdown in the crypto arena. With altcoins waiting in the wings for their moment in the spotlight, Merton leaves us on the edge of our seats, pondering the fate of Bitcoin and its digital brethren in the turbulent seas of the market. In this riveting saga of price action and market dynamics, one thing is certain - with Nicholas Merton at the helm, the journey promises to be nothing short of exhilarating.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch WTF Is Going On With Bitcoin? | It's Time To Pay Attention... on Youtube

Viewer Reactions for WTF Is Going On With Bitcoin? | It's Time To Pay Attention...

Viewer praises the depth and fact-based approach of the analysis

Mention of Litecoin's strength during alt capitulation event

Concern about a potential washout in the market

Discussion on the total number of Bitcoins and MicroStrategy's impact

Speculation on the sustainability of the current rally

Mention of potential manipulation to flush out leverage positions

Questions on BTC's return, ETFs, and potential challenges

Speculation on MicroStrategy potentially owning all BTC

Observation about whales buying ETH

Mention of exchanges flushing out leveraged traders

Related Articles

Unveiling the Economic Crisis: Private Equity's Threat to Businesses and Retirement Savings

DataDash uncovers a hidden crisis in the economy caused by private Equity firms' risky debt practices, threatening businesses and retirement savings. Learn how to protect your financial future in the face of this looming threat.

Crypto Market Update: CME Solana Futures, XRP Lawsuit, Fed Meeting Impact

DataDash covers CME's Solana Futures, XRP lawsuit drop, Fed meeting impact, Q1 end, and Trump's tariff proposal. Bitcoin and Ethereum price analysis, Sui's traction, and key levels are discussed for potential market movements.

Crypto Market Update: Stable Coin Regulations, Binance Delisting, and XRP Surge

The crypto market faces upheaval with stable coin regulations, Binance delisting Tether, and XRP's regulatory clarity. Bitcoin eyes $95,000, XRP targets $3.80 resistance, signaling market shifts ahead.

Satoshi Nakamoto Identity: Is Jack Dorsey the Real Creator of Bitcoin?

Unraveling the mystery of Bitcoin's creator: Could Jack Dorsey be Satoshi Nakamoto? Explore the compelling evidence and contradictions in this intriguing investigation.