Bitcoin Market Cycles: Past Corrections, Institutional Impact & Growth Potential

- Authors

- Published on

- Published on

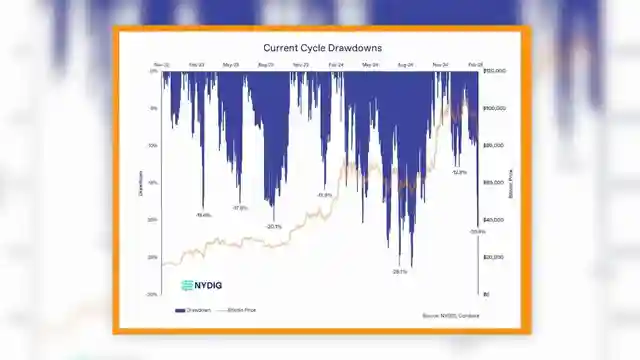

In this riveting analysis, Lark Davis takes us on a rollercoaster ride through the tumultuous world of Bitcoin market cycles. Drawing parallels between past corrections in 2017 and 2021, he poses the burning question: are we witnessing the demise of the current bull market or just a temporary shakeout? With a keen eye for patterns, Davis dissects the market's behavior, highlighting the resilience of Bitcoin in the face of major corrections. He emphasizes the significance of these downturns in clearing out market excesses and setting the stage for future growth.

Delving into the impact of macroeconomic factors on market dynamics, Davis underscores the critical role of liquidity changes in shaping the trajectory of Bitcoin prices. The increasing institutional involvement in the crypto space and its implications for market correlation with traditional equities are also explored. Against the backdrop of regulatory developments and macroeconomic uncertainties, Davis navigates the evolving market landscape with a mix of caution and optimism, hinting at the potential for further upside before a cycle top.

As the narrative unfolds, Davis paints a picture of a market in flux, where history rhymes but doesn't necessarily repeat itself verbatim. With a nod to the past and an eye on the future, he steers viewers through the choppy waters of market volatility, urging them to tread carefully and avoid succumbing to FOMO buying. In a world where fortunes can be made and lost in the blink of an eye, Davis's insights serve as a beacon of wisdom, reminding investors to stay grounded, preserve capital, and weather the storm with resilience and patience.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Warning Bitcoin Holders History Is Repeating on Youtube

Viewer Reactions for Warning Bitcoin Holders History Is Repeating

Market uncertainty and debate on potential outcomes

Discussion on the changing landscape of cryptocurrency investments

Speculation on the current market cycle

Mention of specific cryptocurrencies like $SONY56H and Chainlink

Predictions on BTC resistance levels and potential market movements

Expectations of a significant bull market and alt season

Commentary on the impact of government involvement in cryptocurrency

Personal success stories and investment gains

Observations on market volatility and the need for caution

Comparison of past market cycles and the potential for future trends

Related Articles

Adapting to the New Era: Navigating Crypto's Evolution

Lark Davis explores the evolving crypto landscape, signaling the end of easy gains. Investors must adapt to Wall Street influence, seek new opportunities like humanoid robotics, and embrace strategic profit-taking in a maturing market.

2025 Market Forecast: Tax Cuts, Tariffs, and Crypto Insights

Lark Davis explores the 2025 market outlook, discussing tax cuts, tariffs, and the Federal Reserve's role. Insights on potential market shifts and the impact on investments and cryptocurrencies are shared, offering a glimpse of hope amidst prevailing economic uncertainties.

Unveiling Cryptocurrency Success Illusions: Survivorship Bias, Social Media, and FOMO

Lark Davis debunks cryptocurrency success myths: Survivorship bias distorts reality; social media magnifies illusions; FOMO clouds judgment. True success lies in personal goals and perseverance.

2025 Crypto Trends: Altcoin ETFs, Ethereum Staking, Real Assets, and AI Comeback

In 2025, key crypto narratives include Dino coins eyeing altcoin ETFs, Ethereum's ETF staking feature, rising real-world assets, and the potential comeback of AI coins. Strategic positioning is essential for maximizing investment opportunities in the evolving crypto market landscape.